AB InBev Reports First Quarter 2025 Results

Solid start to the year with EBITDA growth at the top-end of our outlook, continued margin expansion and high-single digit Underlying EPS growth

BRUSSELS--Anheuser-Busch InBev (Brussel:ABI) (BMV:ANB) (JSE:ANH) (NYSE:BUD):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250507671244/en/

Regulated information1

“Beer is a passion point for consumers. The strength of the beer category and the continued momentum of our megabrands delivered another quarter of profitable growth. EBITDA increased at the top-end of our outlook and the ongoing optimization of our business drove Underlying EPS growth of 7.1%. The consistent execution of our strategy by our teams and partners drove a solid start to the year and reinforces our confidence in delivering on our outlook for 2025.” – Michel Doukeris, CEO, AB InBev

|

Revenue +1.5% Revenue increased by 1.5% with revenue per hl growth of 3.7%. Reported revenue decreased by 6.3% to 13 628 million USD, impacted by unfavorable currency translation.

4.4% increase in combined revenues of our megabrands, led by Corona, which grew by 11.2% outside of its home market in 1Q25.

34% increase in revenue of our no-alcohol beer portfolio.

53% increase in Gross Merchandise Value (GMV) from sales of third-party products through BEES Marketplace to reach 645 million USD.

Volumes -2.2% Volumes declined by 2.2%, with beer volumes down by 2.5% and non-beer volumes down by 0.2%. |

Normalized EBITDA +7.9% In 1Q25, Normalized EBITDA increased by 7.9% to 4 855 million USD with a margin expansion of 218bps to 35.6%.

Underlying Profit 1 606 million USD Underlying Profit was 1 606 million USD in 1Q25 compared to 1 509 million USD in 1Q24. Reported profit attributable to equity holders of AB InBev was 2 148 million USD in 1Q25 compared to 1 091 million USD in 1Q24, positively impacted by non-underlying items.

Underlying EPS 0.81 USD Underlying EPS increased by 7.1% to 0.81 USD. On a constant currency basis, Underlying EPS increased by 20.2%. |

|

1The enclosed information constitutes regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. For important disclaimers and notes on the basis of preparation, please refer to page 12. |

Management comments

Solid start to the year with EBITDA growth at the top-end of our outlook, continued margin expansion and high-single digit Underlying EPS growth

Our business delivered another quarter of solid financial performance in 1Q25. EBITDA increased by 7.9% with margin expansion of 218bps driven by top-line growth, cost of sales tailwinds and disciplined overhead management. Underlying EPS was 0.81 USD, a 7.1% increase in USD and a 20.2% increase in constant currency versus 1Q24, driven by 10.3% EBIT growth and the continued optimization of our net finance costs.

Top-line increased by 1.5%, with revenue growth in approximately 50% of our markets, driven by a revenue per hl increase of 3.7% as a result of disciplined revenue management choices and ongoing premiumization. We increased our overall portfolio brand power driven by increased marketing investment and effectiveness. In addition, we estimate that we gained or maintained market share in 60% of our markets. Volume performance was, however, impacted by calendar-related factors such as cycling the leap year selling-day benefit in 1Q24 and Easter shipment phasing, resulting in a decline of 2.2%.

Progressing our strategic priorities

We continue to execute on and invest in three key strategic pillars to deliver consistent growth and long-term value creation.

(1) Lead and grow the category:

We increased our overall portfolio brand power driven by increased marketing investment and effectiveness. In addition, we estimate that we gained or maintained market share in 60% of our markets.

(2) Digitize and monetize our ecosystem:

BEES Marketplace captured 645 million USD in GMV from sales of third-party products, a 53% increase versus 1Q24. Overall BEES GMV increased by 10%, reaching 11.6 billion USD.

(3) Optimize our business:

Underlying EPS was 0.81 USD, a 7.1% increase in USD and a 20.2% increase in constant currency terms versus 1Q24, driven by 10.3% EBIT growth and the continued optimization of our net finance costs.

(1) Lead and grow the category

We are executing on our five replicable levers to drive category growth. Our performance across each of the levers was led by our megabrands which delivered a 4.4% revenue increase.

- Category Participation: Investments in our megabrands and innovations drove an estimated increase of 60 basis points in the percentage of legal drinking age consumers purchasing our portfolio across our key markets, the equivalent of 6 million new consumers on an annualized basis. Participation increases were driven by our megabrands and no-alcohol beer portfolio.

- Core Superiority: Revenue of our mainstream portfolio increased by 0.3%, driven by double-digit growth in South Korea and mid-single digit growth in Colombia and Mexico.

- Balanced Choices: Our balanced choices portfolio of low carb, sugar free, gluten free and no- and low-alcohol beer brands delivered a revenue increase of 2.7%. Growth was led by our no-alcohol beer portfolio which delivered a 34% revenue increase and is estimated to have gained share of no-alcohol beer across our footprint, led by Corona Cero which grew volume by triple-digits.

- Premiumization: Our above core beer portfolio delivered a 1.8% revenue increase. Corona led our performance, increasing revenue by 11.2% outside of Mexico with double-digit volume growth in more than 30 markets.

- Beyond Beer: Growth of our Beyond Beer portfolio accelerated in 1Q25, increasing revenue by 16.6%, led by double-digit growth of Cutwater and Nütrl in the US and Beats in Brazil.

(2) Digitize and monetize our ecosystem

- Digitizing our relationships with more than 6 million customers globally: As of 31 March 2025, BEES was live in 28 markets with 72% of our revenues captured through B2B digital platforms. In 1Q25, BEES captured 11.6 billion USD in GMV, growth of 10% versus 1Q24.

- Monetizing our route-to-market: BEES Marketplace generated 10 million orders and captured 645 million USD in GMV from sales of third-party products, growth of 27% and 53% versus 1Q24, respectively.

- Leading the way in DTC solutions: Our omnichannel DTC ecosystem of digital and physical products generated revenue of approximately 275 million USD. Our DTC megabrands, Zé Delivery, TaDa Delivery and PerfectDraft, generated 19.2 million e-commerce orders and delivered 117 million USD in revenue this quarter, representing 12% growth versus 1Q24.

(3) Optimize our business

- Maximizing value creation: EBITDA grew by 7.9% with margin expansion of 218bps supported by disciplined resource allocation and overhead management. Optimization of our net capex drove increased efficiency in depreciation and amortization expenses, resulting in 10.3% EBIT growth. As of 5 May 2025, we have completed 70% of our 2 billion USD share buyback program announced on 31 October 2024.

- Advancing our sustainability priorities: In Climate Action, our Scopes 1 and 2 emissions per hectoliter of production was 4.44 kgCO2e/hl in 1Q25, a reduction of 45.7% against the 2017 baseline. In Water Stewardship, our water use efficiency ratio improved to 2.44 hl per hl in 1Q25 versus 2.55 hl per hl in 1Q24, as we continue working towards our ambition to reach 2.50 hl per hl on an annual basis by the end of 2025.

Delivering reliable compounding growth

We are encouraged by our results to start the year, the resilience of the beer category and the consistent execution of our strategy by our teams and partners. Our business is local, with more than 98% of our volume locally produced, and our footprint has structural tailwinds for long-term volume growth with favorable demographics, ongoing economic development and opportunities to increase category participation. Our consistent performance and the fundamental strengths of our business reinforce our confidence in our ability to deliver reliable compounding growth and create a future with more cheers.

2025 Outlook

(i) Overall Performance: We expect our EBITDA to grow in line with our medium-term outlook of between 4-8%. The outlook for FY25 reflects our current assessment of inflation and other macroeconomic conditions.

(ii) Net Finance Costs: Net pension interest expenses and accretion expenses are expected to be in the range of 190 to 220 million USD per quarter, depending on currency and interest rate fluctuations. We expect the average gross debt coupon in FY25 to be approximately 4%.

(iii) Effective Tax Rate (ETR): We expect the normalized ETR in FY25 to be in the range of 26% to 28%. The ETR outlook does not consider the impact of potential future changes in legislation.

(iv) Net Capital Expenditure: We expect net capital expenditure of between 3.5 and 4.0 billion USD in FY25.

- WhatsApp获客新篇章 WS协议号群发秘籍

- Instagram自动营销软件 - Ins精准引流助手/全球推广工具

- "掌握WhatsApp拉群艺术,批量群发营销信息不再难

- "掌握广播力量,批量群发新纪元利用WS拉群协议

- 80岁奶奶玩疯了!AI音乐【图个乐】开始内测!AI图生音乐

- 智能潮流导航WhatsApp工具助你轻松穿越商业风云站在最前沿

- Instagram自动化推广利器,ins高效引流神器,ig精准引流,ins协议号

- Instagram怎么养号,ins养号群发私信引流软件,ig群发工具,ins一手协议号

- Instagram引流神器,ins高效引流助手,ig全自动引流 +ins全参协议号

- Instagram群发教程,ins一键采集营销平台,ig引流助手

- Instagram协议私信软件,ins群发营销引流助手,ig群平台

- 数字交易平台的革新力量

- Instagram群发营销工具,ins引流资深教程,ig群发软件推荐

- 中国电子网:赋能数字时代,引领电子产业新飞跃

- 销售低迷时,我遇到了这个Line协议号注册器,现在我的事业重获新生

- Instagram精准引流助手,ins高效营销软件,ig私信引流,ins协议号商

- WhatsApp稳定批量群发秘诀 WS筛选器与最高推广群发助手

- Instagram精准引流神器,ins高效私信软件,ig全自动引流,ins协议号商

- 开普云开悟大模型+知识库:AI行业场景落地的必由之路

- Instagram引流助手-Ins精准推广神器/ig自动私信软件

- Instagram引粉助手/ins全球私信群发软件推荐/ig如何快速引流

- “智算融合 共创未来”——开普云AI战略暨新产品发布会召开

- AI剪辑软件的未来展望 技术与艺术的完美交响

- AB InBev Reports First Quarter 2025 Results

- Instagram群发神器,ins自动采集工具,ig批量私信软件

- Instagram一键营销助手,ins精准群发平台,ig私信神器

- "跨境时空,无界营销,海外大师为您揭示WhatsApp拉群营销的国际商机密码。

- 独创心法 引爆关注 WhatsApp拉群营销工具为你的消息赋予别样创意 激发用户兴趣

- Ins引流工具,Instagram营销软件,助你实现市场吸粉领先!

- Telegram自动加群炒群营销软件,纸飞机最强营销助手

推荐

-

如何经营一家好企业,需要具备什么要素特点

我们大多数人刚开始创办一家企业都遇到经营

科技

如何经营一家好企业,需要具备什么要素特点

我们大多数人刚开始创办一家企业都遇到经营

科技

-

疫情期间 这个品牌实现了疯狂扩张

记得第一次喝瑞幸,还是2017年底去北京出差的

科技

疫情期间 这个品牌实现了疯狂扩张

记得第一次喝瑞幸,还是2017年底去北京出差的

科技

-

升级的脉脉,正在以招聘业务铺开商业化版图

长久以来,求职信息流不对称、单向的信息传递

科技

升级的脉脉,正在以招聘业务铺开商业化版图

长久以来,求职信息流不对称、单向的信息传递

科技

-

全力打造中国“创业之都”名片,第十届中国创业者大会将在郑州召开

北京创业科创科技中心主办的第十届中国创业

科技

全力打造中国“创业之都”名片,第十届中国创业者大会将在郑州召开

北京创业科创科技中心主办的第十届中国创业

科技

-

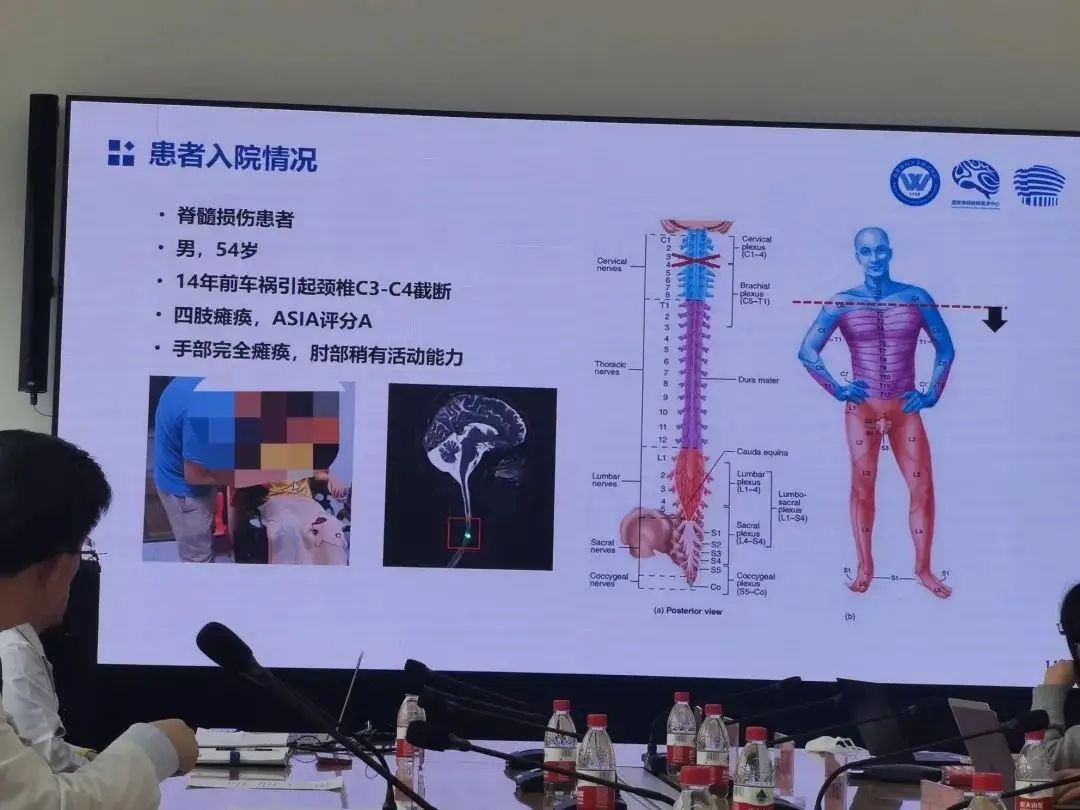

老杨第一次再度抓握住一瓶水,他由此产生了新的憧憬

瘫痪十四年后,老杨第一次再度抓握住一瓶水,他

科技

老杨第一次再度抓握住一瓶水,他由此产生了新的憧憬

瘫痪十四年后,老杨第一次再度抓握住一瓶水,他

科技

-

创意驱动增长,Adobe护城河够深吗?

Adobe通过其Creative Cloud订阅捆绑包具有

科技

创意驱动增长,Adobe护城河够深吗?

Adobe通过其Creative Cloud订阅捆绑包具有

科技

-

苹果罕见大降价,华为的压力给到了?

1、苹果官网罕见大降价冲上热搜。原因是苹

科技

苹果罕见大降价,华为的压力给到了?

1、苹果官网罕见大降价冲上热搜。原因是苹

科技

-

丰田章男称未来依然需要内燃机 已经启动电动机新项目

尽管电动车在全球范围内持续崛起,但丰田章男

科技

丰田章男称未来依然需要内燃机 已经启动电动机新项目

尽管电动车在全球范围内持续崛起,但丰田章男

科技

-

B站更新决策机构名单:共有 29 名掌权管理者,包括陈睿、徐逸、李旎、樊欣等人

1 月 15 日消息,据界面新闻,B站上周发布内部

科技

B站更新决策机构名单:共有 29 名掌权管理者,包括陈睿、徐逸、李旎、樊欣等人

1 月 15 日消息,据界面新闻,B站上周发布内部

科技

-

智慧驱动 共创未来| 东芝硬盘创新数据存储技术

为期三天的第五届中国(昆明)南亚社会公共安

科技

智慧驱动 共创未来| 东芝硬盘创新数据存储技术

为期三天的第五届中国(昆明)南亚社会公共安

科技