Altss Expands OSINT-Powered LP Intelligence to 30,000+ Institutional Investors and Family Offices as

Cybersecurity and OSINT veterans expand allocator coverage to pensions, endowments, and sovereign wealth funds — with 99%+ contact deliverability and a sub-30-day verification standard

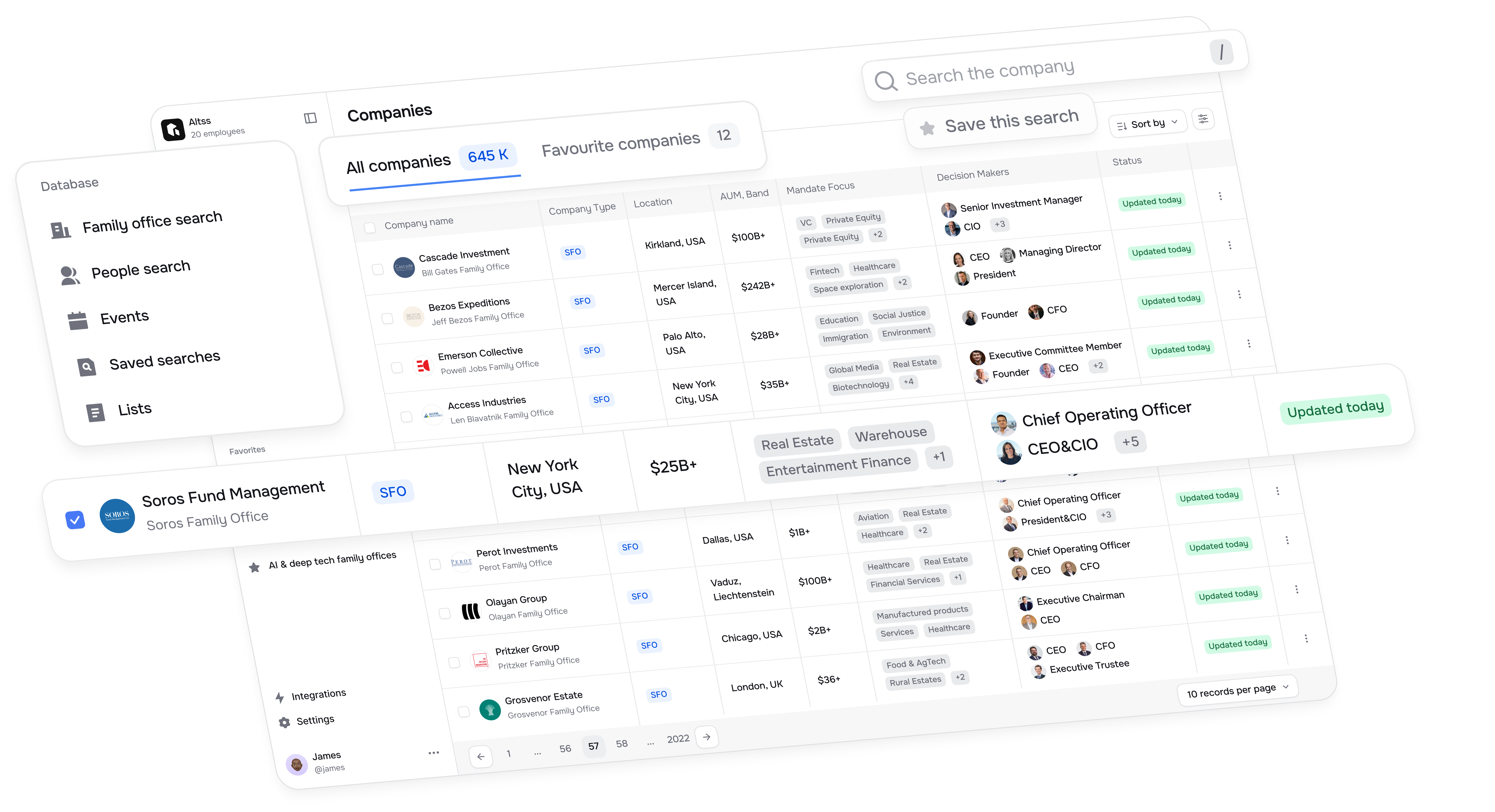

MIAMI, Feb. 10, 2026 (GLOBE NEWSWIRE) -- Altss, the allocator intelligence platform built on open-source intelligence methodology, today announced the general availability of Institutional LP Coverage — expanding its verified dataset to 30,000+ institutional investors and family offices worldwide.

The expansion extends Altss’s sub-30-day data verification standard — already applied across 9,000+ family offices — to pensions, endowments, foundations, insurance general accounts, sovereign wealth funds, consultants, OCIOs, fund-of-funds, and registered investment advisors with alternatives exposure. Every profile includes verified decision-maker contacts, current mandate signals, and source-linked data fields with timestamps showing when each data point was last confirmed.

Altss has seen a sustained increase in inbound interest from capital-raising teams currently using legacy LP databases, with former Preqin and PitchBook subscribers among those who have already migrated to the platform. The most common drivers cited by switching teams: contact data that decays between infrequent refresh cycles, limited family office depth, and platform costs that are difficult to justify against actual fundraising outcomes.

The Market Context

Private capital markets have grown to over $22 trillion in global assets under management, yet the infrastructure supporting fundraising has not kept pace. Median time-to-close for institutional fund commitments has extended to 14-18 months. The number of funds in market has exceeded historical norms while LP deployment pace has slowed — creating an environment where data quality and outreach timing directly determine which managers secure allocations and which are passed over.

At the same time, the LP data market has consolidated. Preqin’s acquisition by BlackRock in March 2025 prompted allocators and fund managers to reassess data independence. PitchBook, owned by Morningstar, serves a broad market spanning deal sourcing, company intelligence, and M&A — making LP coverage secondary to its core platform. For fundraising teams, the question is no longer which legacy database to subscribe to, but whether the legacy model itself still fits how capital is raised.

Why This Team

Altss was not built by database analysts or financial data vendors. The founding team spent years inside global cybersecurity firms and large-scale OSINT operations — environments where data verification is not a product feature but an operational discipline, where source provenance is auditable by design, and where acting on unverified intelligence has real consequences.

That background shaped every layer of the platform. Altss treats allocator data the way a cybersecurity operation treats threat intelligence: continuous collection across structured and unstructured sources, automated cross-referencing against multiple signals, human verification on cadence, and full source lineage on every material field.

Rather than relying on self-reported surveys or analyst-curated directories refreshed on quarterly or semi-annual cycles, Altss runs continuous OSINT pipelines that ingest and cross-reference:

- Regulatory filings across SEC, Companies House, ACRA, and global equivalents

- Personnel signals including executive appointments, team restructurings, and committee changes

- Mandate indicators from public disclosures, RFP calendars, re-up activity, and pacing plan shifts

- Conference and event intelligence from speaker rosters, agendas, and attendee footprints

- Portfolio and co-investment activity from press releases, registry filings, and corporate disclosures

When data cannot be verified to a current standard, Altss flags uncertainty rather than presenting stale information as current — a deliberate design choice that protects compliance workflows downstream.

The Fundraising Gap

For fund managers and institutional investor relations teams — whether raising a $25 million debut fund or managing a multi-billion-dollar capital formation program — the gap between what legacy databases deliver and what modern fundraising requires has widened. Quarterly data refreshes mean contacts go stale mid-campaign. Platforms designed for research analysts don’t serve the operational needs of fundraising teams running targeted allocator outreach across time zones. And bulk-export models have degraded contact quality industry-wide — the same LP inboxes are saturated by hundreds of fund managers working from identical exported lists.

Altss was built to close that gap.

Between September 2025 and January 2026, Altss’s verification pipelines detected decision-maker team changes across more than 8% of tracked family office profiles — turnover that would go undetected in databases refreshed on quarterly or semi-annual cycles.

“Legacy databases sell you a list. We built an intelligence operation. Every LP profile in Altss is source-linked, verified within 30 days, and built on the same OSINT methodology our team applied across cybersecurity and large-scale open-source intelligence — where outdated data isn’t inconvenient, it’s a liability. Fund managers raising capital shouldn’t accept a lower standard for the data that determines whether they close or don’t.”

— Dawid Siekiera, Founder, Altss

What Institutional LP Coverage Includes

Altss now provides signal-driven profiles across every major allocator category:

- Pensions — public, corporate, union, and Taft-Hartley plans

- Endowments — university, hospital, and charitable

- Foundations — private, community, and corporate

- Sovereign wealth funds

- Insurance companies and general accounts

- Consultants and OCIO providers

- Fund-of-funds

- Registered investment advisors with alternatives exposure

- Family offices — 9,000+ single-family and multi-family offices

Profile data includes verified decision-maker contacts with 99%+ email deliverability, current mandate signals, allocation preferences by asset class and strategy, geographic focus, ticket size ranges, and investment staff detail. Coverage is global, spanning North America, Europe, the Middle East, Asia-Pacific, and Latin America.

Relationship Intelligence — Not Just Records

Legacy LP databases were architected over a decade ago as searchable directories — records organized by filters and keyword search. They were not designed to model relationships between entities, trace capital flows across networks, or surface connection paths in real time. That architectural limitation persists today: even after years of incremental updates, no major incumbent offers an integrated relationship graph within its LP platform.

Altss’s infrastructure — built from the ground up for entity resolution, network analysis, and cross-source signal correlation — makes relationship intelligence a natural extension of the platform rather than a retrofit. Later in 2026, Altss will introduce a Relationship Graph that maps how allocators, fund managers, advisors, and co-investors are connected across the private markets ecosystem. The feature will surface:

- Warm introduction paths between a fund manager’s existing network and target allocators

- Co-investment history showing which LPs have previously invested alongside each other

- Shared board seats and advisor relationships across family offices and institutional allocators

- Personnel movement patterns tracking where investment professionals have worked and who they’ve worked with

For fundraising teams, this replaces the manual relationship mapping currently maintained in spreadsheets, CRM notes, and institutional memory — and turns network intelligence from anecdotal to systematic.

How Altss Differs from Legacy LP Databases

| Capability |

Altss | Legacy Incumbents |

| Total allocator coverage | 30,000+ institutional investors and family offices | Reported totals may include non-allocator entities |

| Data refresh cadence | 30 days or less, with high-velocity signals updated within hours | Quarterly or semi-annual survey-based updates |

| Verification method | Continuous OSINT + human verification with source lineage | Analyst-curated, often self-reported |

| Email deliverability | 99%+ verified | Variable; degrades between refresh cycles |

| Family office depth | 9,000+ verified globally, including MENA, LatAm, APAC | Typically U.S./Europe-concentrated |

| Relationship intelligence | Integrated relationship graph (2026) | Not available as native platform feature |

| Data export | In-platform only — protects contact quality | Bulk CSV/API export accelerates contact decay |

| Team background | Cybersecurity and OSINT operations | Financial data and research |

| Architecture | Built 2025 on modern OSINT and AI infrastructure | Built on technology stacks dating back 10+ years |

LP-GP Connect

Alongside institutional coverage, Altss is launching LP-GP Connect — a structured discovery layer where fund managers present live fund opportunities and allocators discover aligned managers through signal-based matching. The feature is built around verified warm paths and mandate alignment rather than mass distribution.

In-Platform by Design

Altss does not offer CSV export, API access, or bulk CRM data sync. All data remains within the platform. This is architecture, not limitation.

Bulk data export is the primary driver of contact decay, inbox saturation, and regulatory risk across the LP outreach ecosystem. When identical contact lists circulate across hundreds of fund managers, deliverability collapses and allocators disengage. Altss’s in-platform model preserves data quality for every client and protects allocator relationships — a direct reason the platform maintains 99%+ deliverability across its dataset.

Pricing

Altss offers transparent, per-seat annual pricing with no per-search fees, no module upsells, and no multi-year lock-in required. Plans are available for emerging managers, standard teams, and enterprise deployments. For pricing details or custom plans tailored to your workflow or organization, reach out at altss.com/book-demo.

Who Uses Altss

Altss is used by fund managers, asset managers, and investment banks across four continents — from teams launching debut vehicles to established programs managing multi-billion-dollar fundraises. Clients include teams that have previously relied on Preqin, PitchBook, FINTRX, and Dakota before migrating to Altss for real-time coverage and verified contact accuracy. Clients collectively oversee trillions of dollars in assets under management. The platform serves fundraising workflows across venture capital, private equity, private credit, real estate, infrastructure, and real assets.

What’s Next

Altss plans further platform expansions in 2026, including its Relationship Graph for mapping allocator networks and warm introduction paths, and additional dataset coverage to be announced. The company’s roadmap is guided by a single principle: allocator intelligence should be real-time, verifiable, and built for how capital is actually raised — not how it was raised a decade ago.

About Altss

Altss is an allocator intelligence platform for private markets. Founded in May 2025 by a team with deep experience in global cybersecurity operations and large-scale open-source intelligence, Altss applies intelligence-grade methodology to LP discovery — delivering verified decision-maker data, real-time mandate signals, and source-linked profiles refreshed on a sub-30-day cadence. The platform covers 30,000+ institutional investors and family offices worldwide, with the deepest verified family office dataset in the market at 9,000+ profiles. Headquartered in Miami, Altss serves clients globally.

Altss is a modern alternative to legacy LP databases such as Preqin and PitchBook for fund managers and institutional investor relations teams who require real-time, verified allocator intelligence for fundraising.

Website: https://altss.com

Book a demo: https://altss.com/book-demo

Media contact:

Tatiana Ledovskikh

pr@altss.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a5ab070e-d936-42af-bd63-4c4738003fbd

This press release was published by a CLEAR® Verified individual.

- 利福国际宣布完成启德项目再融资

- 北京小野吉他沙龙创始人第四次活动《北大纵横百家讲堂》圆满成功

- 在野泽温泉体验真诚的健康关怀:通过中长期住宿促进健康旅游

- 中成康富荣获TÜV 南德 ISO 13485认证 加速全球化战略布局

- 通过全球最严TGA认证,优思益打造全系列高品质健康产品

- 移远通信再推系列高性能卫星、5G、GNSS及三合一组合天线

- 夏小雨:脊髓电刺激助力脊髓损伤患者脱离拐杖自主行走

- 西藏智汇矿业登陆港股:从高原走向国际 独特资源禀赋释放长期增长潜力

- 杭州微短剧大会开幕,短剧厂牌听花岛“让短剧有深度,更有温度”

- 招商蛇口 | 雲蘭169㎡臻藏户型,启幕从容人生

- 聚势·向新而生 | 深视智能2025区域渠道合作伙伴大会圆满举办

- 格雷希尔G70系列密封接头三大体系,多维覆盖工业密封场景

- 御术华医从2015自营到2024加盟,大健康新篇章

- 业绩稳步增长Robotaxi商业化加速推进 如祺出行值得积极关注

- D-Day 北京站 3月30日 DolphinDB 与你帝都见!

- 徐冬冬又一爆剧《致命游戏》上线,“宝藏型演员”实力盖章

- Bedford Metals Completes Sheppard Lake Uranium Project Option Agreement

- 法国娇兰 艺术沙龙 全新香精系列

- 500 Global聘请联合国可持续发展目标(SDG)设计师Alaa Murabit博士,推出公司可持续增长新业务

- TOPCon VS BC 实证数据出炉:1.71%发电增益,优势显著

推荐

-

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

-

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

-

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

-

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯