Five mega-trends reshaping the global energy and resources landscape in 2025

As the energy and resources landscape undergoes rapid transformation in 2025, driven by geopolitical shifts, strategic industrial realignments and accelerating technology change, Wood Mackenzie has released five charts that spotlight the most significant trends reshaping the sector globally in its latest Horizons report.

Featured in 'Conversation starters: Five energy charts to get you talking', offer insight into two defining macro themes: the intensifying rivalry between the world's two superpowers, and Europe's mounting competitiveness challenges amid ongoing industrial decline.

“Between the unstoppable rise of US LNG, the political posturing around rare earth elements, the devastating uncertainty in the UK North Sea, the clear-out in European petrochemicals, and the AI-driven power demand surge, these trends track the wonders and the warnings of the energy and resource transition in 2025 and beyond,” said Malcolm Forbes-Cable, Vice President, Upstream and Carbon Management Consulting at Wood Mackenzie.

US LNG: the turnaround of all turnarounds

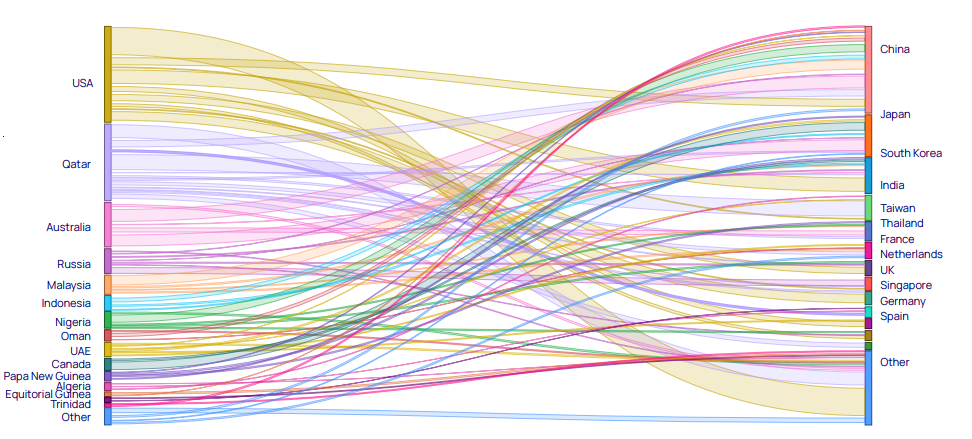

Global LNG exports and imports by country, 2030

Note: Forecast provides an optimised view of uncontracted global LNG flows. Data shown as a percentage of global volumes Global LNG exports and imports by country, 2030

Source: Wood Mackenzie, Global Gas Model

The US has emerged as the world's hydrocarbon superpower, exemplified by its meteoric rise in the Liquefied Natural Gas (LNG) market.

- By 2030, the US is projected to account for 30% of global LNG output.

- You don't need to look too far back to find a US which was building LNG import infrastructure and now in under 10 years it has become the world's largest LNG exporter.

- The US also leads global oil production (including oil, condensate, and natural gas liquids), delivering one-fifth of the world's volumes. In comparison, its closest competitors, Saudi Arabia and Russia, produce only 65% and 50% of US volumes, respectively.

“The resurrection of US LNG is a crucial reminder of what a resource-rich, free-market country like the US can do. This hydrocarbon hegemony is now being leveraged as a diplomatic tool,” Forbes-Cable remarked.

Rare earth elements – a high note in global trade

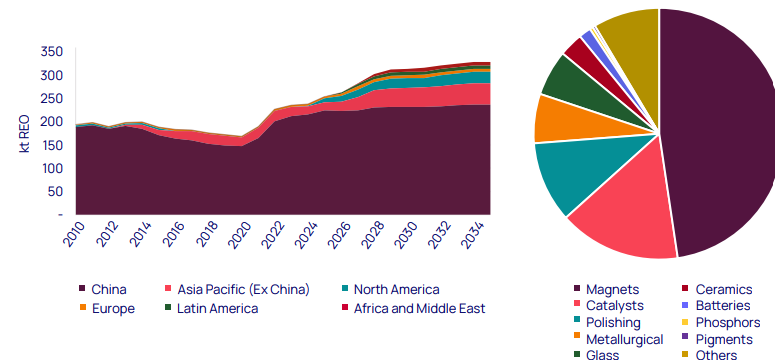

Rare earth elements refined supply outlook (left) and rare earth applications (right)

Source: Wood Mackenzie, Rare Earths Market Service

Rare earth elements have moved to the centre of global trade negotiations, becoming a focal point of the growing interplay between materials science and high-tech industrial strategy. Their role spans critical applications, including renewable energy technologies, advanced weapon systems, electronics, and semiconductors, positioning them at the heart of geopolitical competition. Magnets alone account for almost half of all rare earth elements use.

- China currently commands an extraordinary strategic advantage, accounting for almost 90% of the world's refined rare-earth supply.

- This leverage is particularly striking given that the US was the world's leading producer until the late 20th century.

National value destruction in the UK North Sea

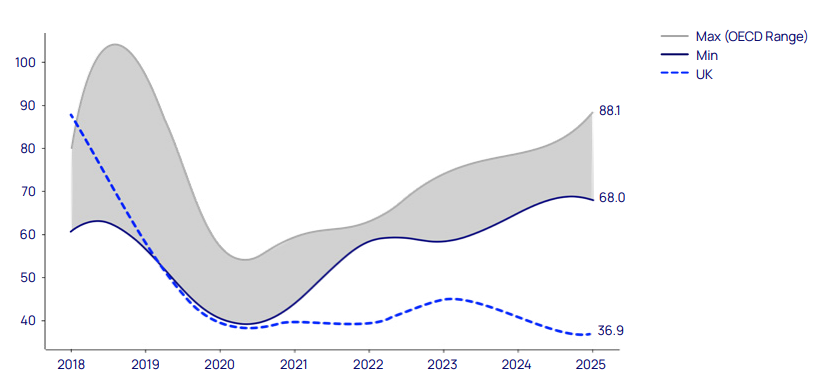

Implied long-term oil price (ILTOP) for OECD countries and the UK (US$/barrel)

Source: Wood Mackenzie, M&A Service

The UK oil and gas sector has become an egregious outlier among OECD countries due to persistent fiscal and regulatory uncertainty, leading to significant value destruction.

- The Implied Long-Term Oil Price (ILTOP) for transacted UK North Sea assets is charting around US$40 per barrel, a whopping 40% discount compared to the OECD average of roughly US$70 per barrel.

- This discount reflects the upstream industry's declining interest, spurred by five major changes to the fiscal system in two and a half years mixed with regulatory uncertainty.

“The scale of the discount reflects the reality of how seriously investors view the UK's fiscal and regulatory instability. Frequent shifts to the fiscal regime and ongoing regulatory uncertainty have weakened confidence and held back capital. The chart makes clear the value destruction in the UK's upstream sector,” Forbes-Cable added.

Petrochemical clear-out: Europe's declining capacity in a hot growth sector

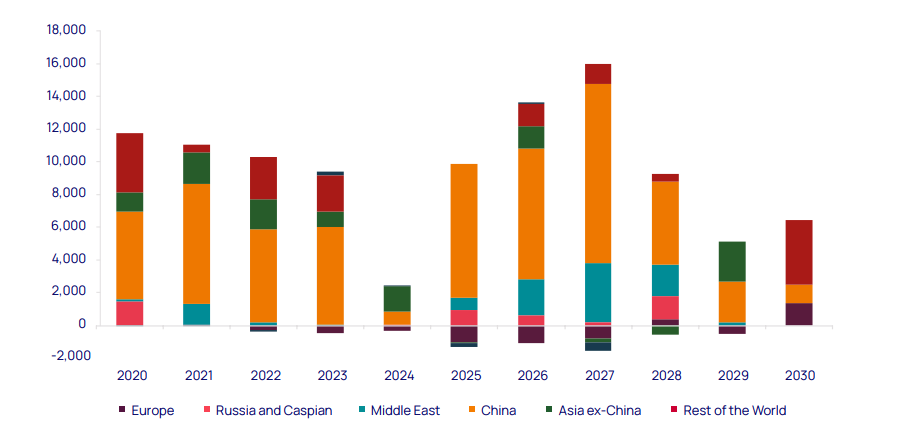

Global ethylene capacity change by region (kt)

Source: Wood Mackenzie Chemicals

Europe is driving down emissions, but a less positive side effect is de-industrialisation, as industrial activity is transferred to other regions.

- Global ethylene manufacturing capacity shows a pattern of closures in Europe contrasting sharply with significant growth elsewhere, especially in China.

- The plant closures between 2022 and 2027 represent an annual loss of about US$4 billion in gross value added to the European economy.

- This all comes with significant human cost. The announcement of the closure of ExxonMobil's Fife Ethylene Plant in Scotland, Europe's fourth largest by capacity, will lead to 400+ job losses.

Power up: the engine of AI growth

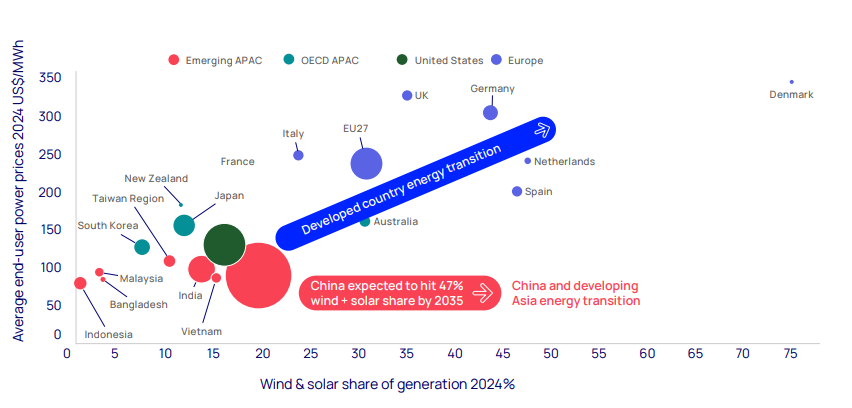

End-user power prices vs the wind and solar share of generation, by country

Note: Bubble size represents size of the power market in 2024

Source: Wood Mackenzie, Lens Power

The Artificial Intelligence (AI) megatrend is driving growth in global power demand. The US power market, a low-growth zone for decades, is forecast to see its AI-driven power demand grow at a massive compound rate of 20% to 2030. There is a growing call on gas-fired power, but with rising gas prices and the rapid inflation of build costs for new power plants power prices are expected to rise.

- Data centre operating costs are typically about half power-related, making electricity prices a crucial factor in the global AI race.

- Europe's economic disadvantage due to high power prices is apparent in a chart mapping national power prices against wind/solar generation share. China, conversely, has very competitive power prices and with 47% of its power generation forecast to come from wind and solar by 2035, combined with its dominance of the renewable's technology supply chain, power prices are expected to remain low.

Please find the full report here: Conversation starters: Five energy charts to get you talking

- Acronis Appoints Gerald Beuchelt as Chief Information Security Officer

- 从线上问诊到线下见面,御君方如何用“公益见面”诠释有温度的医疗?

- “解码生命奥秘,守护健康未来”,生命健康基地盛大启幕

- 「毅」专访 | 喆塔科技:自研一站式CIM2.0,打造半导体行业的“新质生产力”

- 德艺双馨艺术家--盛瑞吉

- 男性生殖健康管理的奠基者与东方养生智慧现代:苑长受邀出席第二十五届世纪大采风品牌人物盛典

- 喜讯!大明山感仙茶厂入选品牌强国优选工程茶行业典范企业

- 春分踏青正当时 百胜中国以消费场景创新激活春日经济

- 远程M5醇氢牵引车交付河北客户 赋能当地煤炭运输行业实现绿色转型

- Xsolla与Pocket Gamer Connects合作,为2025年移动游戏开发者赋能

- 颖奕生物科技荣获ISO 9001认证 ,点亮品质升级新航程!

- “新春开门红,森赫电梯喜获三项大奖,开启2024热辣滚烫新篇章”

- 中國石墨(2237.HK)推進天然石墨一體化產業鏈 於山東佈局下游業務

- LyondellBasell and Covestro announce permanent closure of PO11 unit at Maasvlakte

- 探索设计无限灵感丨意大利施恩德&华人设计家「北京篇」三日设计游学完美落幕

- Pepperstone 宣布成为 AFC Asian Cup Qatar 2023™ 的地区合作伙伴

- 将党建优势不断转化为竞争优势

- 通用技术集团战略投资加速国产替代,东软医疗重磅推出光子CT

- 芯引擎 新纪元,阿诗特能源LABEL工商业储能系统重磅升级

- Avance Clinical 在亚太地区进一步扩张,韩国新的临床运营

- 2024上海《July 5-7》第24届海外置业移民留学展览会

- “跨越山之海,奔赴云之南” 智云健康公益活动暨捐赠启动仪式在京举行

- 新质生产力重塑时尚产业格局,广州白马采购节开幕

- 盛翔酒业:打造中国酒业新生态,引领电商时代的酒类购物新体验

- 当德国精工邂逅东方七夕,Liebherr利普赫尔冰箱为爱定制鲜甜时光

- 临商银行罗庄支行积极开展防盗抢安全生产演练

- UTD Platform 百大城市启动会:掀起短剧娱乐新风潮

- 张柏芝《V》五月刊登封 携De Beers戴比尔斯珠宝共成风华

- 宜美照明AI超节能改造:助力商业与工业照明高效升级

- 配备八个扬声器的Lenovo Tab Plus,音乐爱好者的梦想平板电脑,绝不错过任何一个节拍

推荐

-

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

-

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

-

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

-

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

王自如被强制执行3383万

据中国执行信息公开网消息,近期,王自如新增一

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯