Global power demand surge puts net zero by 2050 out of reach as world heads toward 2.6°C warming, sa

NEWS RELEASE

Global power demand surge puts net zero by 2050 out of reach as world heads toward 2.6°C warming, says Wood Mackenzie

AI boom and geopolitical tensions strain energy systems; a 30% increase in annual investment to US$4.3 trillion needed to limit warming to 2°C; China takes global leadership in energy transition

LONDON, HOUSTON, SINGAPORE, 29 October 2025 – Surging power demand from artificial intelligence and mounting geopolitical tensions have made 2050 net zero goals unattainable, with the world now on track for 2.6°C of global warming, according to Wood Mackenzie's 'Energy Transition Outlook 2025-2026' report.

The analysis shows that achieving a 2°C warming limit would require US$4.3 trillion in annual investment between 2025-2060 and reaching net zero emissions by around 2060. Energy sector investment must grow from 2.5% of global GDP today to 3.35% within the next decade.

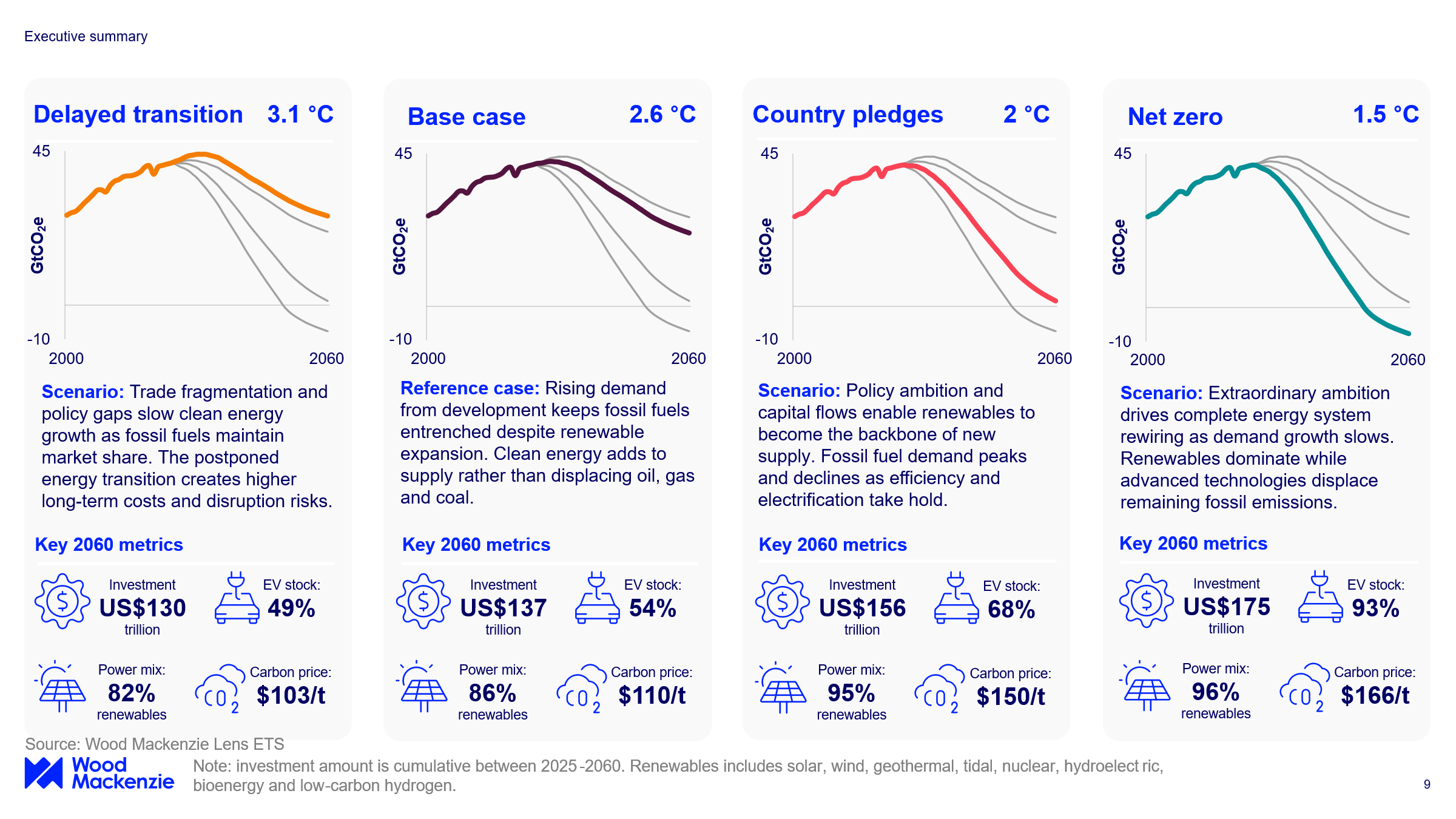

The new report 'Energy evolution in the age of superintelligence' analyses four different pathways for the energy and natural resources sector – Wood Mackenzie's base case (2.6-degrees), country pledges scenario (2-degrees), net zero 2050 scenario (1.5-degrees) and delayed transition scenario (3.1-degrees).*

KEY FINDINGS:

- Few countries in total, and no major G7 countries, are on track to meet 2030 emissions goals.

- A significant investment increase could still limit the average temperature increase to within 2°C warming by reaching global net zero emissions by around 2060.

- Energy sector capex must grow from 2.5% to 3.35% of global GDP to reach net zero.

- Base case emissions trajectory has moved up slightly, with peak emissions in 2028 and the rate of decline slowing to 2% per annum since the last update, representing now a 2.6°C warming.

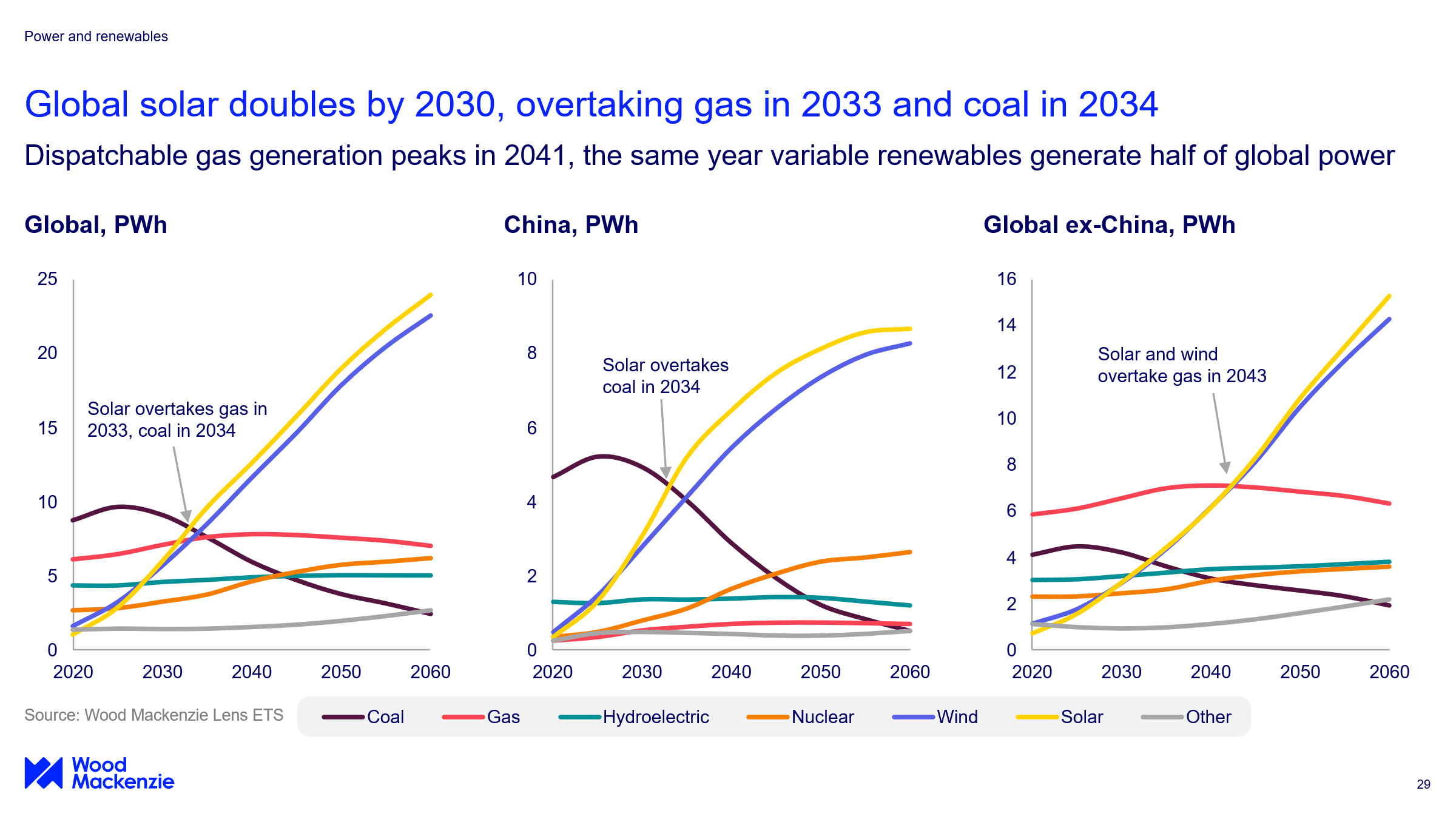

- Variable renewables will surge from 20% of generation today to 60% by 2050, with solar alone doubling by 2030 and overtaking gas in 2033 and coal in 2034. Battery storage and nuclear provide flexibility to renewable-heavy grids.

- Oil demand peak has shifted from 2030 to 2032, reflecting sluggish EV sales in the US and Europe, and continued momentum in petrochemicals. AI surge supports gas across all scenarios, pushing demand up by 180 bcm by 2050 than our previous outlook.

“The energy system is becoming more complex, interconnected, and, volatile,” said Prakash Sharma, vice president, head of scenarios and technologies for Wood Mackenzie. “As power demand surges due to the expansion of technologies such as AI and electrification, what was once a mostly aspirational shift towards decarbonization is now facing the hard trade-offs of scale, system integration, capital allocation and geopolitics.

“The share of solar and wind in global power supply has grown from 5% to 20% over the past decade and the surge is expected to continue. But accelerating from deployment to a deeply decarbonized, resilient energy system is proving far more complex than simply adding megawatts.”

Transition hits headwinds in the West; climate leadership shifts to China

No major economy remains on track to meet its 2030 targets, with Wood Mackenzie's Country Pledges scenario projecting net zero emissions only after 2060 – well behind 2050 timeline scientists deem necessary.

“A new climate leadership is emerging,” said Sharma. “As the US doubles down on fossil fuels, pushing allies to buy its LNG, China is seizing the low-carbon mantle through EV and solar dominance, plus aggressive renewables deployment. Europe maintains the strongest net zero ambitions, viewing clean technologies as essential for economic and energy security.

“While a faster transition appears more expensive in the near-term due to compressed investment timelines, delaying it carries the risk of significantly higher costs longer term towards climate adaptation. The decade ahead presents critical climate checkpoints that will determine whether meaningful decarbonisation remains achievable with significant investment increases.”

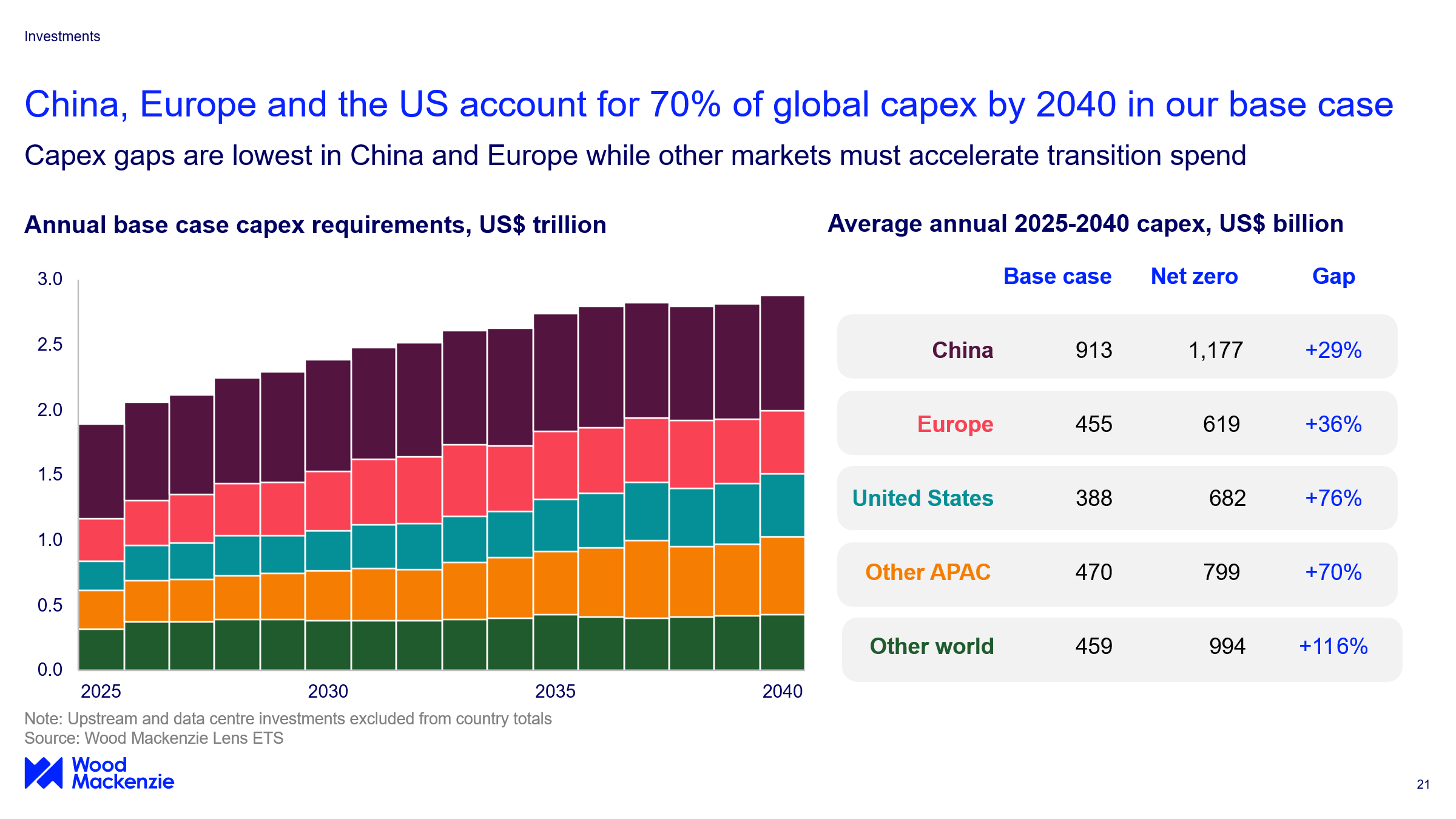

The United States faces the steepest investment challenge among major economies. According to Wood Mackenzie's Lens Energy Transition Scenarios (ETS), the US must increase annual climate transition spending 76% to reach net zero, a significant jump that far exceeds the investment increases needed in China and Europe.

China, Europe, and the US account for 70% of global capex by 2040 in the base case:

- China: $913B annually (base case) vs $1.177T (net zero) - 29% increase needed

- Europe: $455B annually vs $619B - 36% increase needed

- United States: $388B annually vs $682B - 76% increase needed

- Other regions face significant gaps, with other APAC nations and the rest of the world needing to more than double transition spending

Critical Minerals: The New Strategic Battleground

Clean technologies rely heavily on lithium, nickel, cobalt, copper, and rare earth elements. Supply chains are highly concentrated, with China dominating lithium and rare earth refining, creating new geopolitical dependencies. A typical battery electric vehicle requires 6x more critical minerals than an internal combustion engine vehicle (450 kg vs 78 kg).

“This concentration gives resource holders new leverage, while importing countries, in turn, are racing to secure offtake deals, diversify supply and build stockpiles,” said Sharma. “Critical minerals have become the new strategic battleground: their availability and affordability will shape not just technology costs but also the balance of power in a new energy landscape. Resource nationalism is shifting from fossil fuels to critical minerals.”

AI Revolution Strains Power Systems

The AI boom is creating unprecedented electricity demand, with data centers consuming 700 TWh in 2025 (exceeding electric vehicles) and potentially doubling by 2030. This surge threatens electricity crises and higher tariffs while derailing 2030 clean power commitments. However, AI itself may accelerate breakthrough technologies and optimise energy systems, as advanced simulations, optimise materials performance, and enable efficient design configurations at unprecedented speed.

Electricity Becomes the Dominant Energy Carrier

Electricity demand will expand from one-fifth of final energy consumption today to over half by 2050 under net zero scenario. Variable renewables will surge from 20% of generation today to 60% by 2050, with solar alone doubling by 2030 and overtaking coal by 2034. However, variable renewables reach their practical ceiling at 68% in our scenario due to grid stability and storage limitations. At the same time, dispatchable fossil fuels remain essential; coal continues powering developing economies while gas turbines provide critical backup where renewable infrastructure struggles with massive new load.

Oil and Gas Face a "Long Goodbye"

Oil demand peak has shifted from 2030 to 2032 in our base case, reflecting continued momentum in road transport and petrochemicals. Natural gas maintains its position as a bridge fuel, especially where coal must be displaced. The persistence reflects structural inertia and energy security concerns, but the ingredients for faster change are strengthening as renewables and EVs continue breaking cost records.

CCUS, Hydrogen and Advanced Bioenergy Fill Critical Gaps

Advanced technologies are emerging as critical enablers for hard-to-abate sectors like heavy industry, long-haul transport, and legacy fossil infrastructure. While facing barriers of scale, cost, and capital, these technologies are essential for comprehensive decarbonisation where electrification falls short. In net zero pathways, these technologies can deliver 20% to 30% of total emissions reductions: the difference between incremental progress and comprehensive decarbonisation.

Connecting energy ecosystems

The report concludes that the energy transition is evolving as it enters a more mature and stress-tested phase, facing hard trade-offs of scale, system integration capital allocation and geopolitics.

“Viewing the energy system as interconnected is more critical than ever because electrification, flexibility and decarbonisation link markets that once stood apart,” said Sharma. “Oil, gas, coal and power can no longer operate in silos: EV adoption shifts electricity demand, gas shortages ripple into power and heating, and investment in shared infrastructure like transmission lines, pipelines and storage affects multiple sectors at once.

“Geopolitical shocks or resource constraints in one fuel cascade across others, while technologies such as hydrogen, CCUS and biofuels rely on cheap renewables and common infrastructure. Treating energy carriers as separate markets risks missing the synergies and vulnerabilities that define the transition.”

The report comes as countries prepare nationally determined contributions ahead of COP30, with nearly half of global emissions now covered by 2035 climate pledges.

- ENDS -

EDITOR'S NOTES

About Wood Mackenzie's Energy Transition Outlook analysis

Wood Mackenzie's Energy Transition Outlook report (part of our Lens Energy Transition Scenarios) maps four distinct energy transition pathways with increasing levels of ambition, including the role of emerging technologies and investment opportunities. They are our independent assessment of what it would take to deliver on countries' announced net zero pledges and potential outcomes for the planet.

You can read more information here and a copy of the analysis is available on request.

Definition of scenarios:

Base case - Wood Mackenzie's base case view across all commodity and technology business units – our central, most likely outcome calls for a 2.6 C trajectory.

Country pledges scenario - Wood Mackenzie's scenario on how country pledges may be implemented in the future. The 2˚C trajectory aligns with the upper temp limit from the Paris Agreement.

Net zero 2050 scenario - Wood Mackenzie's scenario on how a 1.5˚C world may play out over the next 35 years. Carbon emissions align with the most ambitious goal of the 2015 Paris Agreement.

Delayed transition scenario - Assumes a five-year delay to global decarbonisation efforts due to geopolitics and reduced policy support to new technologies, resulting in a 3.1 ˚C degree trajectory.

Charts:

For further information please contact Wood Mackenzie's media relations team:

ENDS

For further information please contact Wood Mackenzie's media relations team:

Mark Thomton - Americas

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon - APAC

+65 8533 8860

hla.myatmon@woodmac.com

Chris Boba - EMEA

+44 7408 841129

Chris.Boba@woodmac.com

Angelica Juarez - AMERICAs

angelica.juarez@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That's why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years' experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers' decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com

- CHMP Recommends Approval of Galderma’s Nemolizumab for Moderate-to-Severe Atopic Dermatitis and Prur

- 智控未来,感知万物:迪富电子以全链技术赋能全球智能生态

- DC农业数智订单农业服务中心亮相京津冀蔬菜产业发展大会

- 西安钢管批发什么价?焊管、镀锌钢管、西安镀锌钢管供应来临潼

- 百胜中国地铁早餐车 延伸多一份“获得感”

- 82% 的中国工人希望机器人提供帮助 - 2025 年 Automatica 趋势指数调查

- 比亚迪亮相慕尼黑The Smarter E Europe,庆祝户储百万安装佳绩

- 诺为泰为加强全球业务扩张特任命Yooni Kim博士为亚太地区执行总裁

- 福建漆宝斋与世界品牌丹拿至尊大漆系列作品在广州成功发布

- 探索数字疗法产业价值新路径,第三届中国数字疗法产品质量与法规研讨会在上海举行!

- 千年风华,温润如玉——探寻和田玉的千年魅力

- 汇邦咨询:助力企业解锁政策红利,打造申报服务新标杆

- CallTower and Five9 Announce Global Select Resale Partnership

- Cirium的Emerald Sky将带来飞机排放和燃油消耗数据准确性的变革

- 西安区域医学检验中心丨培训赋能,助力基层检验能力提升

- 数智创新领航产业升级!弘正储能全新数字系统产品闪耀ESIE 2025

- Mohawk 在 2023 年影响力报告中重点介绍可持续发展进展

- “谨慎投资”时代,格林豪泰4.0为加盟商提供更多“确定性”

- 中国企业加速出海步伐,尼尔森IQ研讨会揭示欧洲及亚太市场新机遇

- 泰兴“金”浪涌,佳乐猛肥种出泰兴好“麦”望

- Witsbb健敏思斩获2025年度跨境领航奖,以无敏初心定义跨境营养新标杆

- 倍享阳光助力少年抗击白血病 ——阳光人寿上海分公司快速完成2024年首例重疾先赔案

- 广东时装周携手广州国际轻纺城评选十家非遗品牌 广州巨隆纺织获此殊荣

- 乡村振兴,电商先行:探索电商助力乡村脱贫致富新路径

- 中医护夏进行时!羊爸爸线下中医馆“防暑公益活动”让夏天更清凉

- 喜讯 江苏国耕农牧科技有限公司 耕鲜地系列食品被授予“一带一路国宾伴手礼”荣誉

- 世贸通巴拿马买房移民:从申请到获批,20天拿下巴拿马PR的实战经验

- 杨树龙 ——中国画画穆斯林世界百米长卷总策划

- Julius Meinl小红帽咖啡:打工人午后焕新活力的神器

- 载誉而归!兰希黎荣获2025深美协・大湾区“金梧桐奖”

推荐

-

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

-

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

-

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯