European refiners may hold the key to scaling green hydrogen, says Wood Mackenzie

PRESS RELEASE

European refiners may hold the key to scaling green hydrogen, says Wood Mackenzie

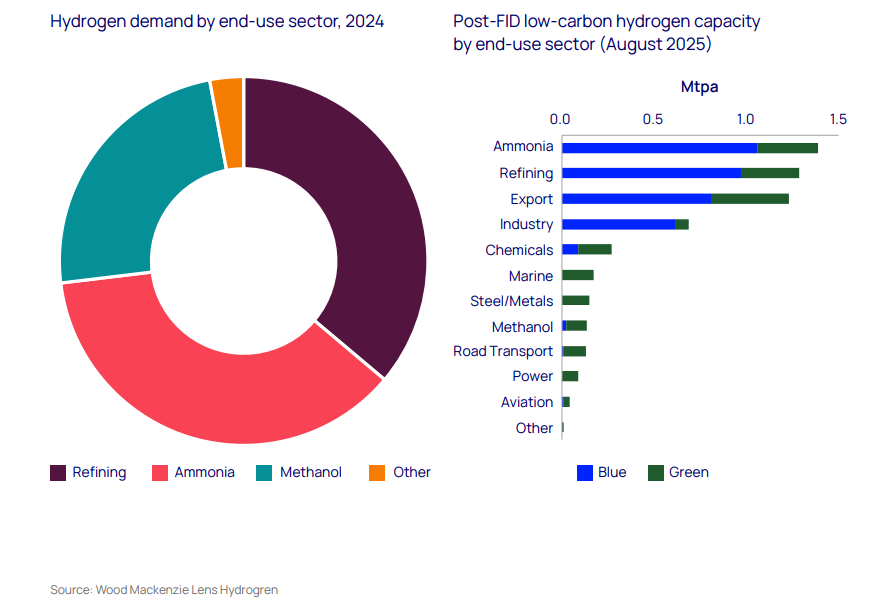

• Globally, refining currently accounts for 36% of all hydrogen demand

• EU regulations favor green over blue hydrogen

• Strong policy is needed to reach targets and costs must come down

• Marine and aviation sectors offer significant growth potential

LONDON/HOUSTON/SINGAPORE, 21 August 2025 - High costs have kept green hydrogen projects from taking off, but new regulations in the European Union's (EU) refining sector offers a solution to launching this carbon friendly technology at scale, according to a new Horizons report from Wood Mackenzie.

According to the report, “Isn't it ironic? How Europe's oil refiners could offer a route to scale up green hydrogen”, European refiners are set to require ~0.5 million tonnes of green hydrogen annually by 2030 to comply with EU regulations, replacing about 30% of current CO2-emitting hydrogen production. Refining represents one of the largest hydrogen opportunities globally, which, alongside ammonia and methanol production, accounts for 98% of current demand.

The latest revision of the EU's Renewable Energy Directive (known as RED III), favors green hydrogen over blue hydrogen, helping to minimise the delays and cancellations now all too common when it comes to green hydrogen globally.

"European refiners are set to become significant producers or buyers of green hydrogen, initially to decarbonise the refining sector and its derivatives as fuel for marine and aviation," said Alan Gelder. "Numerous green hydrogen projects have already targeted the sector."

The report finds that of the 6 Mtpa of low-carbon hydrogen capacity that has taken a final investment decision (FID), European refineries have already committed more than US$5 billion of capital.

Refiners demonstrate strongest market appetite

Recent EU Hydrogen Bank auction results reveal refineries' commitment to green hydrogen adoption, with the sector showing the highest willingness to pay premium prices at an average levelised cost of hydrogen of US$9.23/kg - demonstrating their requirement to meet regulatory mandates. This compares favorably with Wood Mackenzie's asset-level modeling of refinery-targeted projects, which produces costs of US$7.04 to US$8.30/kg.

The encouraging market signals extend beyond pricing. Average green hydrogen costs dropped 18% in the latest EU auctions, with German bids falling more than 55%. However, progress remains uneven across the bloc, with slow national adoption of RED III legislation hampering project development in many member states.

Long-term growth lies in transport fuels

While refinery decarbonization offers the strongest near-term investment case, the marine and aviation sectors present massive long-term growth opportunities for green hydrogen derivatives. The EU's ReFuelEU Aviation framework alone requires sustainable aviation fuel to power 6% of the jet pool by 2030, with 1.2% coming from green hydrogen-based e-fuels.

By 2050, sustainable aviation fuel mandates could require 8 million tonnes of green hydrogen - representing a compound annual growth rate of over 15% for this sector alone. Similarly, Europe's FuelEU Maritime Regulation and the International Maritime Organization's Net Zero Framework are driving interest in hydrogen-derived marine fuels.

"The opportunities for low-carbon hydrogen have come full circle," said Murray Douglas, Vice President of Hydrogen Research at Wood Mackenzie. "The traditional sectors of refining, ammonia and methanol are showing the most progress, ahead of the many other new demand sectors being touted for hydrogen. Parts of the refining sector can be decarbonised quickly – and at an acceptable cost. But it requires policy intervention to lower green hydrogen production costs and increase the refineries' offtake."

Douglas added: "Marine and aviation hold much of the long-term potential for hydrogen derivatives, as these sectors are the most challenging to electrify. The challenge lies in competing fuels, the costs of production and the final shape of the policies providing support."

Policy gaps remain key barrier

Despite the progress, significant hurdles remain. Current EU policy requires RFNBOs to account for only 1% of transport sector energy use by 2030 - a modest target that reflects the challenges in expanding supply. Member states have been slow to transpose RED III into national legislation, creating regulatory uncertainty that has slowed project development across most of the EU.

The report concludes that while European refiners could play a critical role in scaling up the green hydrogen industry, success depends on continued cost reductions and stronger policy support to fully kick-start demand across the continent.

ENDS

For further information please contact Wood Mackenzie's media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

Chris Boba

+44 7408 841129

Chris.Boba@woodmac.com

Angelica Juarez

angelica.juarez@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That's why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years' experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers' decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

- 大东江冷面:搭乘年货进京专列 龙江老字号特产温情献礼

- 丰田合成推出适用于车载空调的超薄寄存器

- Invixium Acquires Triax Technologies to Expand its Biometric Solutions with AI-based RTLS Offering f

- YOYO哥哥不是回來「回憶殺」——是來造星的!宋翊彰 x 蔣雪櫻,合體打造亞洲夢舞台!

- 贝氏评论:因应中国经济增速放缓,贝氏发布有关中国国家风险评估的常见问题解答

- 新中央酒店荣获第十九届中国文旅星光奖「年度设计精品酒店」

- EDC养生工作室:将个性化医疗带入平民家庭

- 首届中国游戏开发与创业者峰会将于洛杉矶举行

- 农发行长治市分行开展“学雷锋志愿服务月”启动仪式暨志愿服务活动

- 打造金融服务行业标杆,助力财富增值-山东旭飞汽车服务有限公司

- 中信银行潍坊分行积极开展“3•15”消费者权益保护宣传活动

- 兰希黎美肤团第 11 次走进大凉山:十年公益路 点亮求学梦

- 永升为“爱”,37度暖心相守-西部区域

- NOBLEROYCE罗慕路斯门窗 以精工匠造开启私属人生

- 万亩桔香 千人畅跑——2025大理乡愁马拉松年度接力赛宾川站开跑

- Hyatt和Grupo Piñero宣布计划成立战略合资企业以推动Bahia Principe Hotels & Resorts品牌的成长

- 富通保险宣布将更名为周大福人寿保险有限公司

- 君国联盟:PCPC消费养老创业平台

- Lenovo™亮相MWC 2025:拓展人工智能驱动的创造力、生产力和创新力边界

- Global Policy Makers and Tech Giants to Convene in Abu Dhabi for Inaugural Summit on Governance of E

- 云顶新耀EVER001亮相ERA 2025 探索原发性膜性肾病治疗新路径

- Alpha系统联结大数据、GPT两大功能,助力律所管理降本增效

- 2025首届商学院戈壁友谊赛燃情启幕,佰穗莱专业营养助力戈壁极限挑战!

- Award-Winning Decision Intelligence Firm Quantexa Accelerates Global Momentum, Announces Strong FY24

- “慕”光而来“全球首家奥特曼冰雪世界”7月12日震撼试营业

- 2025年医疗器械革命:创新技术引领行业未来

- 傲基股份敲响港股上市铜锣 全球化视野下长期价值凸显

- 2024年WORLDCOM奖颁奖典礼于2024年6月5日在东京举行

- 东莞市仕达首饰礼品有限公司-------高端艺术珠宝首饰、五金饰品制造品牌

- Imua Raises $5M Seed Round to Launch the AWS for Trust

推荐

-

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

-

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

-

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

男子“机闹”后航班取消,同机旅客准备集体起诉

1月4日,一男子大闹飞机致航班取消的新闻登上

资讯

-

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯