BTCS Inc. ETH and Cash Market Value Now $242 Million

Agrees to issue approximately $10 Million Convertible Notes at $13 per share, a 198% premium to July 18 close

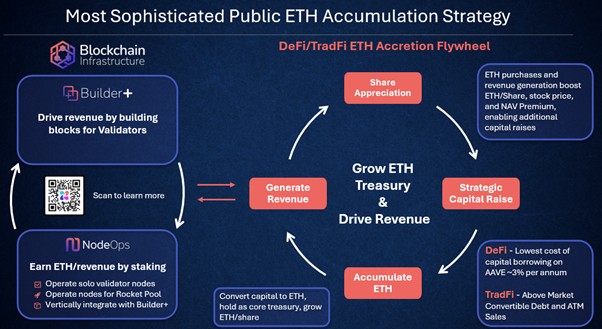

$189 million raised year-to-date through hallmark DeFi/TradFi Accretion Flywheel strategy

SILVER SPRING, MD, July 21, 2025 (GLOBE NEWSWIRE) -- BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”), a blockchain technology-focused company, short for Blockchain Technology Consensus Solutions, today announced that the combined market value of its 55,788 ETH holdings, cash1, and other liquid holdings are approximately $242.2 million, based on an ETH price of $3,600. Additionally, the Company has agreed to issue $10 million in convertible notes through its previously established $56 million arrangement with ATW Partners LLC.

While the funding is extremely modest relative to the $189 million raised year-to-date, the nearly 200% conversion premium is consistent with, and further demonstrates, BTCS’s execution of its hallmark DeFi/TradFi Accretion Flywheel strategy. The Company limited this financing to $10 million as part of its strategy to maintain financial flexibility for opportunistic future leverage while maintaining its loan-to-value ratio below 40%. This approach aligns with BTCS’s commitment to maximizing ETH exposure and minimizing shareholder dilution.

DeFi/TradFi Accretion Flywheel Update

BTCS is successfully executing its DeFi/TradFi Accretion Flywheel capital formation strategy, leveraging both decentralized and traditional finance to expand its ETH holdings, capitalize on its vertically integrated operations, and enhance shareholder value. The Company has raised capital through a mix of at-the-market equity sales, above-market convertible debt, and DeFi-based borrowing, executed in alignment with its strategy to optimize ETH exposure while actively managing dilution, as detailed below.

Year-to-Date Funding Summary

ATM Sales: $132 million1 (70%)

Above-Market Convertible Debt: $17 million (9%)

Aave Stablecoin Loans (DeFi): $40 million (21%)

Total year-to-date funding: $189 million

Total Crypto & Cash Assets: $242 million1

ETH Holdings: 55,788 (average cost per ETH: $2,846), a 516% year-to-date increase

“We believe that BTCS is the most financially and operationally leveraged Ethereum play in public markets today,” said Charles Allen, CEO of BTCS. “Our vertically integrated block-building and node operations are generating record revenue, and when combined with solid execution of our hallmark DeFi/TradFi Accretion Flywheel, BTCS offers investors scalable, high-growth exposure to Ethereum.”

________________________________

1 Inclusive of $28.4 million ATM sales at $7.9 per share pending settlement and funds from the pending closing of the $10 million convertible note.

Above Market Convertible Note Financing

The $10 million principal amount notes are convertible into common stock at a fixed conversion price of $13 per share, representing a 198% premium over the Company’s $6.57 closing stock price on Friday, July 18, 2025. The notes have a two-year maturity, expiring on July 21, 2027, include a 5% original issue discount, and bear interest at an annual rate of 6%.

In connection with the note issuance, five-year warrants will be issued at closing to purchase 879,375 shares of common stock at an exercise price of $8 per share, representing a 122% premium to the closing price on Friday, July 18, 2025. The funding is expected to close on or before Tuesday, July 22, 2025.

Notably, the financing involves no investment banking fees or restrictive terms typically associated with using an investment bank or placement agent, which could hinder the execution of the Company’s DeFi/TradFi Accretion Flywheel strategy.

As part of the financing terms, the Company agreed that, while the notes remain outstanding, it will not amend its non-convertible Series V Preferred Shares to allow for conversion into common stock for a period of 18 months.

Capital Structure Update

To help investors accurately assess BTCS’s intrinsic value and compare it with its peers, we’re providing an updated breakdown of our capital structure. This summary provides additional information to supplement our SEC filings.

| Equity Instrument | Outstanding | Fully Diluted |

| Common Shares | 45,761,072 | 45,761,072 |

| Common Shares - Subject to Forfeiture | 1,149,801 | 1,149,801 |

| Convertible Debt (Conversion Price = $5.85) | 1,334,679 | |

| Convertible Debt (Conversion Price = $13.00) | 773,078 | |

| Convert Warrants #1 (Exercise Price = $2.75, exp. 5/13/2030) | 532,191 | |

| Convert Warrants #2 (Exercise Price = $8.00, exp. 7/21/2030) | 879,375 | |

| RD Warrant (Exercise Price = $11.50, exp. 3/4/2026) | 712,500 | |

| Employee Options (Weighted Average Exercise Price = $2.44) | 1,561,410 | |

| Total | 46,910,873 | 52,704,106 |

Approximately 16 million shares of Series V are now excluded from the fully diluted share count, as they are non-convertible and, under the terms of the note financing, cannot be amended to be convertible for 18 months.

In light of the restriction and given the new administration’s growing acceptance of crypto and the broader recognition that real-world assets will be tokenized, the Company may re-explore various options to create liquidity for the Series V preferred shares, including potential tokenization on Ethereum’s blockchain. However, it is still very early, and the Company can provide no guarantees or assurances that it will be able to tokenize or create liquidity for the Series V and may ultimately seek to convert the Series V to common stock when the restriction expires. As such, the Series V has been excluded from the table above.

About BTCS:

BTCS Inc. (“BTCS” or the “Company”), short for Blockchain Technology Consensus Solutions, is a U.S.-based Ethereum-first blockchain technology company committed to driving scalable revenue and ETH accumulation through its hallmark strategy, the DeFi/TradFi Accretion Flywheel, an integrated approach to capital formation and blockchain infrastructure. By combining decentralized finance (“DeFi”) and traditional finance (“TradFi”) mechanisms with its blockchain infrastructure operations, comprising NodeOps (staking) and Builder+ (block building), BTCS offers one of the most sophisticated opportunities for leveraged ETH exposure, driven by scalable revenue generation and a yield-focused ETH accumulation strategy. Discover how BTCS offers operational and financial leveraged exposure to Ethereum through the public markets at www.btcs.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release constitute “forward-looking statements” within Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 including statements regarding creating high growth exposure to Ethereum, creating liquidity for Series V, and closing of the $10 million note offering. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon assumptions and are subject to various risks and uncertainties, including without limitation market conditions, regulatory issues and requirements, unanticipated issues with our At-The-Market Offering facility, unexpected issues with Builder+, as well as risks set forth in the Company’s filings with the Securities and Exchange Commission including its Form 10-K for the year ended December 31, 2024 which was filed on March 20, 2025. Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information follow us on:

Twitter: https://x.com/NasdaqBTCS

LinkedIn: https://www.linkedin.com/company/nasdaq-btcs

Facebook: https://www.facebook.com/NasdaqBTCS

Investor Relations:

Charles Allen – CEO

X (formerly Twitter): @Charles_BTCS

Email: ir@btcs.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d2a20376-f8bd-4008-9c82-cdb4bc63b69e

- Synchronoss 在巴塞罗那世界移动通信大会上发布 Capsyl Cloud

- 备战比武丨厉兵秣马淬火炼钢奋勇争先全力备战

- Hazer 成功在商业示范工厂生产首批氢气和石墨

- 融味东西 识厨解味——马爹利携手2024米其林指南共启赏星之旅

- 数智创新领航产业升级!弘正储能全新数字系统产品闪耀ESIE 2025

- TOPCon多发2.87%,国家光伏、储能实证实验平台(大庆基地)实证实验成果

- 中国新诗名家展示馆暨林莽诗画工作室开馆仪式在安新举行

- SMART Modular 世迈科技推出高性能服务器专用全新CXL® 内存扩充卡系列

- 泰康之家城市站正式上线,高品质养老社区再添新篇章

- WEF25:沙特阿拉伯 “重写经济剧本”

- 月满云山 同贺华诞 云山天地联合幸福金龄会共庆中秋华诞

- “红旗渠精神永流传”河南省钟表业商会赴红旗渠学习

- 北京中弘晟新能源科技副总经理白智勇一行应邀到江苏、安徽考察调研

- 科技营销,可视赋能丨SciMarket赛美科发布仪式在杭州举行!

- 上线 Airflow 官方!DolphinDB 带来数据管理新体验

- Xsolla将本地支付选项扩展至中东和北非地区以覆盖更多玩家并提高顶级增长市场的收入

- 法国娇兰与全球品牌代言人杨洋携手十载,礼赞蛇年新春,共赴璀璨未来

- 质量基石的守护者:检测检验行业赋能高质量发展

- 黄国民|林泉之心——2024当代山水画中坚30家学术邀请展

- 国家中级消防设施操作员考试时间确定!附全年考试批次及备考规划

- 赵传2025年巡演首站宁波开唱 为粉丝置办“签名墙”仪式感拉满

- 奥看科技携手安庆移动签订交通大模型框架合作协议,共谋交通大模型合作新篇

- ChinaBio®2025邀请中国Biotech企业共赴生物药出海新征程,4月23-24日上海见

- 技术革新 引领行业高效巡检新篇章

- 贸发局三月珠宝双展 携手谱奏闪烁乐章

- 春节期间服务难?大金品牌宣布“春节不打烊”

- 【民族文学】还原,让过往成就未来——郭金世诗集《青瓦诀》序

- COVON全意卫生巾粉熊守护系列 —— 为年轻女孩的舒适与自信护航

- 福州爱尔眼科金牌检眼师王静荣获福建医科大学医学技术与工程学院“2024学年优秀带教教师”称号

- 金风科技创新项目获新疆技术发明一等奖

推荐

-

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

-

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

-

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

-

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

-

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯