New energy realities could extend coal’s role in global energy markets

Wood Mackenzie new Horizons report shows how energy security concerns, unprecedented power demand, and technological advances could extend coal’s life and reshape the global energy transition

Global coal demand could remain stronger for longer, with coal-fired power generation potentially staying dominant through 2030, well beyond current projections for peak coal, according to a new Horizons report from Wood Mackenzie.

The report titled ‘Staying power: How new energy realities risk extending coal’s sunset’ suggests that a confluence of factors, from a rapidly electrifying global economy to energy security priorities rising from geopolitical and cost shocks to Asia’s young and evolving coal fleet, could extend coal’s role as a vital power source well into the next decade and beyond.

“Extending coal's prominence through 2030 would fundamentally alter the global energy transition timeline. We're talking about delaying the phase-out of the world's most carbon-intensive fuel source during a critical decade for climate action,” said Anthony Knutson, global head, thermal coal markets at Wood Mackenzie. “While the long-term trajectory towards renewables remains intact, the path is proving far more complex than many anticipated as countries grapple with energy security and affordability concerns.”

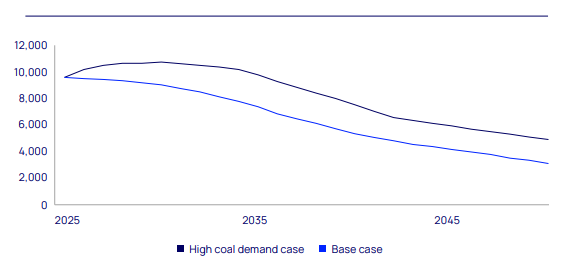

In Wood Mackenzie’s base-case Energy Transition Outlook, coal-fired power generation is projected to decline by nearly 70% between 2025 and 2050. This decline is driven by decreasing renewable energy costs, advancements in battery storage technology, a resurgence in nuclear energy, and an increase in natural gas capacity. However, Wood Mackenzie’s latest Horizons report highlights the potential for coal to remain demand to be stickier than expected. A ‘high coal demand’ case that offers a significantly different perspective: coal generation could average 32% higher than the base case through 2050.

Under the high coal demand case, output from global coal fleets is optimized to help meet steep and rapid load growth expectations, leading to significantly less renewable and gas energy deployment. This equates to 2,100 gigawatts (GW) less global wind, solar, energy storage, and natural gas capacity between 2025 and 2050. Without carbon capture and storage investment, unabated emissions from the coal sector would increase by two billion tonnes compared to the base case scenario.

Total global coal electricity generation, unabated, terawatt hours (TWh)

Source: Wood Mackenzie

Investment headwinds and shifting market forces

The latest Horizons report notes that a higher coal demand case will expose investment gaps in replacement coal supply, potentially raising prices by 2030. “Private equity and sovereign wealth funds will be needed to fund greenfield and brownfield mine expansions,” said Knutson. “We expect most Western financial institutions to continue limiting thermal coal investments, with the strongest impact on supply growth from 2025-2030 and longer-term market implications if supply replacement momentum is not maintained.”

According to the report, lack of commensurate investment is the largest risk facing coal markets now. Wood Mackenzie expects higher coal prices to erode the fuel's core cost advantage if demand increases without a supply response. “While we understand coal demand may remain resilient in coming years, eventually supply constraints will emerge, and this could accelerate price increases globally and erode future demand,” said Knutson.

Reimagined coal power offers potential pathways

The potential for carbon capture, utilisation, and storage (CCUS) offers a pathway to extend coal’s operational life in a decarbonising world. “CCUS could theoretically transform coal's environmental profile by capturing carbon dioxide emissions before they enter the atmosphere, but the economics remain challenging without substantial policy support and capital investment,” said David Brown, director, energy transition practice at Wood Mackenzie.

“Higher coal utilisation rates would improve the investment case, but we're still years away from cost-competitive deployment at scale, particularly in Asia, where carbon storage costs are likely to limit widespread adoption,” he added.

As governments and asset owners reposition for a low-carbon future, technologies that reduce the carbon intensity of coal must be prioritised. Without innovation in areas like CCUS, co-firing and flexible, load-following coal capacity to work in concert with renewables, a high coal demand scenario becomes increasingly difficult to justify. Where CCUS is deployed, pairing it with gas-fired generation may offer a more efficient path, given the lower CO₂ capture requirements per unit of electricity produced.

A new paradigm for global energy planning

While increased coal consumption represents neither an inevitable outcome nor an optimal scenario, current market trends indicate a significant transformation in global energy priorities. As nations develop comprehensive energy planning strategies, they are increasingly prioritizing energy sovereignty and domestic resource control to support their long-term objectives. This shift reflects countries' efforts to accelerate electrification initiatives that are both cost-effective and dependable for their populations, while maintaining greater autonomy in their energy planning decisions.

“Despite potential higher coal demand, we have the tools to phase it out,” Brown concluded. “Without urgent actions, the world faces a growing risk of drifting towards a 3°C pathway. Our high coal demand case is not a forecast, but it’s a warning of what inaction could bring, and a reminder of what can still be prevented.”

- 2025维州美食生活消费品展隆重启幕,优思益携精准营养方案闪耀亮相

- “追光逐梦,让选择熠熠生辉” 展鸿教育20周年庆典隆重举行

- Allegro DVT 推出首款基于 AI 的神经视频处理 IP

- Intelsat利用双卫星解决方案为帕劳提供前所未有的连接能力

- 新书推荐《如烟》——在岁月长河中探寻生命的意义 王淮 著

- 西部数据携全新解决方案亮相FMS2024,推动释放人工智能创新力量

- 冷柜品牌口碑发布,澳柯玛品牌美誉度连续多年居首

- 恒洁获评2025中国品牌500强卫浴榜首 以高质量发展提升国民生活品质

- 深度研报:四大逻辑支撑复星国际估值修复

- 长续航+大负载 七腾防爆四足机器人开启智能巡检的全新时代

- WS市场颠覆者:WhatsApp工具以创新之光助您在业务中赢得先机

- 花些时间 加点爱 fresh馥蕾诗精选520告白礼

- 解密成都誊虞橦服饰有限公司童装纯天然、透气性、吸湿性较好的柔软面料

- 顺义临河 重磅利好:R4,他来了!

- Kinaxis宣布与渥太华大学建立共同开发合作伙伴关系

- 想做拉皮?首选北京嘉美信马双飞-贝壳无痕筋膜提升

- 北新路桥集团西安分公司机关开展“三八”妇女节春游踏青活动

- 心脏支架后易猝死,步长青花瓷脑心通胶囊保周全

- 雪都火焰蓝丨迈向‘实战演练’ 聚焦‘制胜能力

- 西江月·奋斗在中华民族伟大复兴的大道上

- 北单在全国哪些省市可以购买?北京单场实体店通宵营业(威信547216)

- 天花板级油画作品!艺术家陈岚《自在莲莲》系列画作,8月20日开拍,中国现代画莲第一人”陈岚绘画作品

- Medical devices, SMEs in healthcare: 4,000 companies at risk of default due to new tax – reports LaP

- 【公司研究报告】伟仕佳杰:数字时代服务升级,AI、信创拉动增长

- 半岛航空(Jazeera Airways)联手1GLOBAL推出“半岛eSIM服务”

- 喝永和万事和 永和豆浆线上线下玩转新年营销

- 儿童面霜就选“零感薄面霜”!小浣熊,“零感薄面霜”开创者

- Monsha'at: Biban24 fuels regional SME growth and development with landmark agreements worth ove

- ABS Approves Ammonia Fuel Supply System for Nikkiso Clean Energy & Industrial Gases

- 怡和嘉业:“从第四到第二”的壮阔征程

推荐

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

-

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

周星驰新片《少林女足》在台湾省举办海选,吸引了不少素人和足球爱好者前来参加

周星驰新片《少林女足》在台湾省举办海选,吸

资讯

-

中国减排方案比西方更有优势

如今,人为造成的全球变暖是每个人都关注的问

资讯

中国减排方案比西方更有优势

如今,人为造成的全球变暖是每个人都关注的问

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯

-

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

中央气象台连发四则气象灾害预警

暴雪橙色预警+冰冻橙色预警+大雾黄色预警+

资讯

-

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

-

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯

新增供热能力3200万平方米 新疆最大热电联产项目开工

昨天(26日),新疆最大的热电联产项目—&md

资讯