India's economic surge to drive global energy demand, but with low-carbon twist

India's economic surge to drive global energy demand, but with low-carbon twist

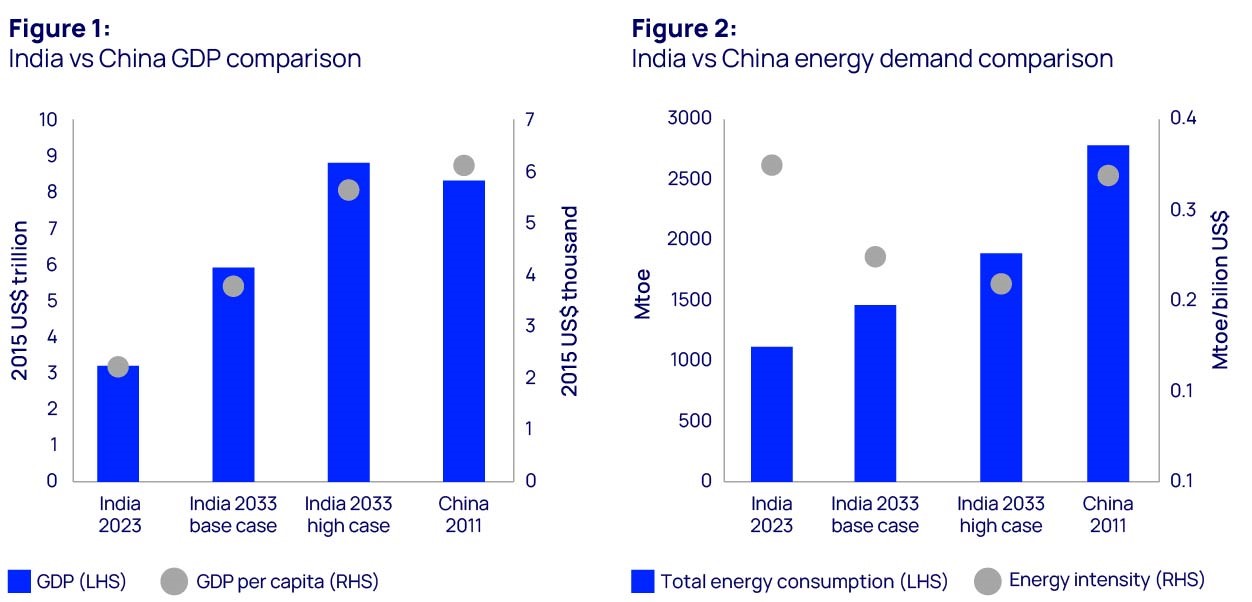

The country's high-growth scenario could triple India's economy by 2033, but impact on global energy markets differs from China's boom

India is set to become a major player in the global energy markets with a unique growth path, featuring lower energy intensity, a diverse energy mix and increased commodity imports, Wood Mackenzie's latest Horizons report reveals.

The report, ‘Eye on the tiger: How higher Indian economic growth could impact global energy markets', highlights that, unlike China's energy-intensive boom in the early 2000s, India's growth is expected to be more balanced, with a focus on high-value manufacturing and renewable energy.

“India's growth story shares similarities with China's rapid expansion, but crucial differences set it apart,” said Yanting Zhou, principal economist at Wood Mackenzie. “While energy demand will surge, India's industrial sector is less energy-intensive, and the country is better positioned to adopt efficient, low-carbon technologies compared to China in the 2000s.”

This unique trajectory could accelerate India's transition to a low-carbon economy, potentially enabling the nation to achieve its net-zero emissions goal ahead of the 2070 target.

According to Wood Mackenzie's high-growth scenario for India, by 2033:

- the economy to reach just under US$9 trillion, nearly triple from US$3.2 trillion

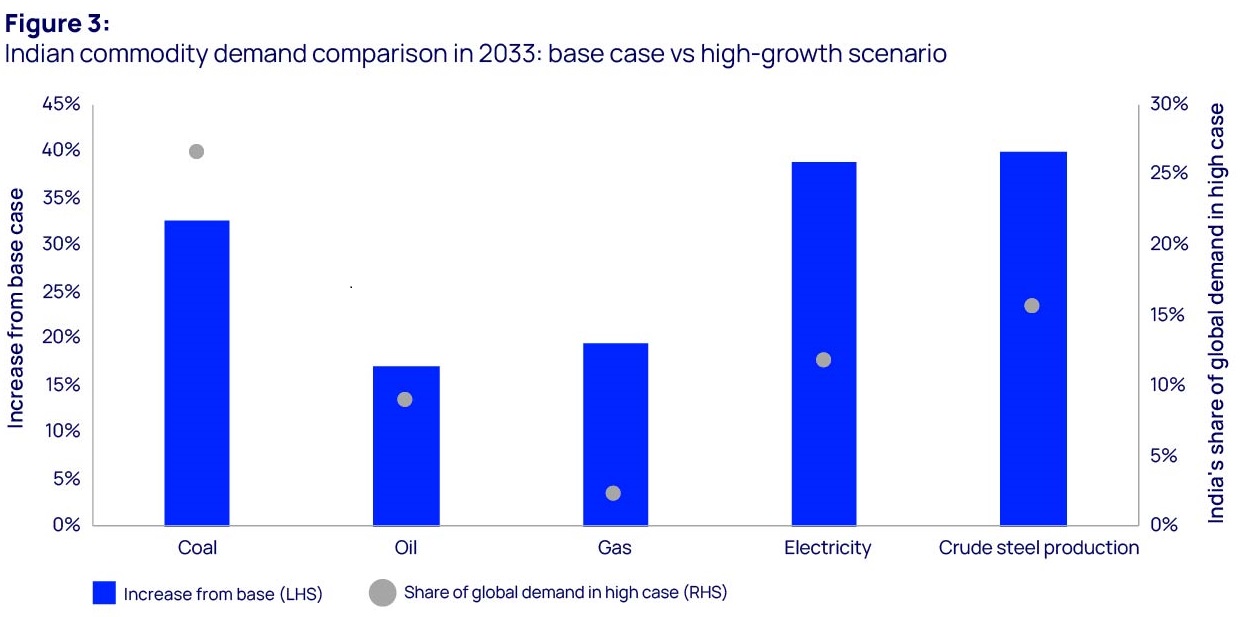

- coal demand to grow nearly doubles to 2.2 billion tonnes

- oil demand to reach 8.2 million barrels per day, up from 5.6 million barrels per day

- power demand surges to almost 4,000 TWh, with significant increases in both coal and renewable generation

- steel demand to rise 9% annually, reaching 317 million tonnes

Source: Wood Mackenzie

Different industrial structure: India's growth focuses on high-value-added manufacturing, including renewables and advanced batteries, which is supported by government subsidies and technological advancements.

Lower energy intensity: India's industrial sector currently consumes less energy per unit of GDP than China did in the early 2000s. By 2033, crude steel and cement production in India is projected to be only about one-third of China's output in 2011, according to Wood Mackenzie's high-growth scenario. Additionally, an increasing share of renewable energy and the adoption of electric vehicles will further lower India's energy intensity.

Modest impact on global energy prices: In a high-growth scenario, while competition for commodities is expected to rise, India's growing demand is not likely to trigger the significant price surges that occurred during China's boom in the 2000s. The spare capacity of OPEC+ is generally sufficient to accommodate the increasing oil demand from India. As a result, India's oil demand is projected to increase Brent prices by a relatively modest US$1 to US$3 per barrel.

The additional demand for 10 million tons per annum (Mtpa) of LNG from India will arise during a period when global gas prices are expected to decline. The market is preparing to absorb more than 200 Mtpa of LNG supply growth, which accounts for about 50% of current supply, limiting potential price increases for LNG.

India's thermal coal production could reach 1,800 metric tons (Mt) by 2033 in the high-growth scenario, driven by the need to ensure energy security. But the country will still need to import around 200 Mt from the seaborne markets. Therefore, the current seaborne thermal coal cost, approximately US$107 per tonne, could rise to US$110 per tonne by 2033.

Emissions trajectory: While CO2 emissions initially rise due to the rapid expansion of coal, India's high-growth scenario could accelerate low-carbon supply chain development, potentially enabling faster decarbonisation post-2030s.

Roshna Nazar, research analyst, energy transition at Wood Mackenzie, said, “If India can repeat China's post-2010 strategy of investing in low-carbon supply chains for solar, wind, electric vehicles, and critical minerals, the higher emissions anticipated in the early 2030s will be temporary. This stronger growth could lay the groundwork for faster and more durable decarbonisation to follow.”

Source: Wood Mackenzie

Opportunities for global producers, challenges for domestic policy

Energy and natural resources producers are likely to benefit from increased demand, particularly those located in Russia, the Middle East, Australia, Indonesia, and South Africa. However, investors will need to prioritise securing a first-mover advantage before domestic companies scale up, as noted by Wood Mackenzie.

Wood Mackenzie estimates that India will need to invest US$600 billion in its power sector over the next decade. This investment presents a significant investment opportunities for power generation capacity additions, grid improvements, and supply chains.

The Indian government is well-positioned to implement innovative strategies that balance energy security, emissions reduction, and economic growth, all while ensuring affordable energy access. By implementing supportive policies—such as streamlined approval processes, attractive incentives for renewable energy projects, and the promotion of public-private partnerships—India can significantly decrease its reliance on commodity imports after 2035. This shift could improve the balance of payments, reduce public debt, and boost foreign reserves.

Zhou concluded, “In addition to rising imports, achieving higher growth will require significant investment in domestic energy production, oil refining, steelmaking, and low-carbon supply chains. Just like in China during the 2000s, there are many opportunities to explore.”

*Definition of scenarios:

- Base case - Wood Mackenzie's base case view across all commodity and technology business units – our central, most likely outcome.

- High-growth scenario: Wood Mackenzie's scenario on how the Indian economy between 2024 and 2033 could achieve a similar level of growth to the Chinese economy between 2001 and 2011 with a different set of economic structures.

ENDS

For further information please contact:

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Chris Boba

+44 (0)7887 495481

Chris.boba@woodmac.com

The Big Partnership (UK PR agency)

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That's why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years' experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers' decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

- 亿活布拉氏酵母菌散品牌宣传片正在各大电视媒体热播

- “商都有礼 匠心臻品”——打造商都县城市IP

- Instagram全球私信群发软件,ins引流助手,ig群发工具/ins引流协议号

- 光明乳业:用数字力量支撑中国乳业高质量发展

- 钢网清洗剂助力电子制造质量提升

- 旺旺O泡围绕抱抱主题,打造多场景治愈巡演

- 龙岩外墙彩绘手绘艺术公司团队【美佳彩绘】

- 公益体彩 乐善人生 乐行时分听歌会开唱

- 卓翼智能荣获双重殊荣,持续领航无人机领域

- UN Adopts 28 January as International Day of Peaceful Coexistence, Backed by King Hamad Global Cente

- 比克动力多款半固态电池通过针刺试验,市场放量在即

- JAKALA Emerges as a European Data-Driven Powerhouse

- 国研茗萃年度盛典暨文票挂牌启动大会在云南西双版纳圆满举行

- 青少年食品安全与营养健康科普教育活动走进合肥

- Snail Games Enhances Current Game Titles with Exciting New Developments

- 重庆120救护车润兴医疗服务站为重症患者提供安全转运

- 云洪酒业:打造高品质酒水供应链,开启微信电商新纪元

- 一个神奇小球囊将脱离的视网膜“顶”回去,为患者带来新选择——福州爱尔眼科

- OpenX Promotes Mitchell Greenway to Managing Director, APAC

- 世优科技虚拟主持人“阿央”亮相全球数字经济大会数字消费节

推荐

-

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

海南大学生返校机票贵 有什么好的解决办法吗?

近日,有网友在“人民网领导留言板&rdqu

资讯

-

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯

抖音直播“新红人”进攻本地生活领域

不难看出,抖音本地生活正借由直播向本地生活

资讯

-

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

透过数据看城乡居民医保“含金量” 缴费标准是否合理?

记者从国家医保局了解到,近期,全国大部分地区

资讯

-

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

国足13次出战亚洲杯首次小组赛0进球

北京时间1月23日消息,2023亚洲杯小组

资讯

-

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

私域反哺公域一周带火一家店!

三四线城市奶茶品牌茶尖尖两年时间做到GMV

资讯

-

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

产业数字化 为何需要一朵实体云?

改革开放前,国内供应链主要依靠指标拉动,其逻

资讯

-

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

大家一起关注新疆乌什7.1级地震救援见闻

看到热气腾腾的抓饭马上就要出锅、村里大家

资讯

-

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

奥运冠军刘翔更新社交账号晒出近照 时隔473天更新动态!

2月20日凌晨2点,奥运冠军刘翔更新社交账号晒

资讯

-

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

一个“江浙沪人家的孩子已经不卷学习了”的新闻引发议论纷纷

星标★

来源:桌子的生活观(ID:zzdshg)

没

资讯

-

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯

看新东方创始人俞敏洪如何回应董宇辉新号分流的?

(来源:中国证券报)

东方甄选净利润大幅下滑

资讯